Micro-Electro-Mechanical Systems (MEMS) Market by Sensor Type (Inertial, Pressure, Microphone, Environmental, and Optical), Actuator Type (Optical, Inkjet Head, Microfluidics, and RF), Vertical, and Geography - Global Forecast to 2022

Years considered for this report

2016: Base Year

2017: Estimated year

2022: Forecast year

2017–2022: Forecast Period

The objectives of the report are:

- To define, describe, and forecast the overall MEMS market on the basis of sensor type, actuator type, vertical, and geography

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the MEMS market

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To conduct a detailed value chain analysis of the MEMS market

- To analyze the opportunities in the MEMS market for stakeholders and provide the details of the competitive landscape for the market leaders

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To analyze competitive developments such as expansions, mergers and acquisitions, and product launches, along with research and development (R&D) in the MEMS market

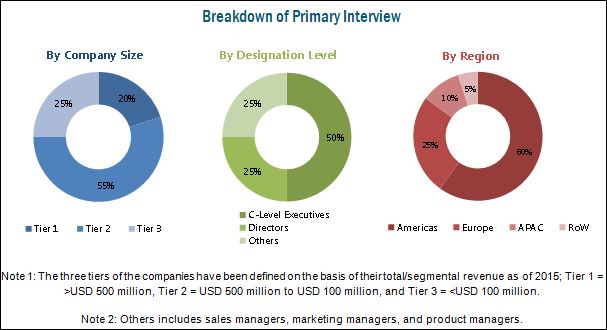

The research methodology used to estimate and forecast the MEMS market begins with capturing data on key vendor revenue through secondary sources such as Semiconductor Industry Association, Global Semiconductor Alliance, and MEMS & Sensors Industry Group. Moreover, the vendor offerings are taken into consideration to determine the market segmentation. A combination of top-down and bottom-up procedures has been employed to arrive at the overall size of the MEMS market from the revenues of key players in the market. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been verified through primary research by conducting extensive interviews with people holding key positions such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries is depicted in the following figure:

To know about the assumptions considered for the study, download the pdf brochure

This report provides valuable insights on the ecosystem of the MEMS market such as raw material suppliers, MEMS manufacturers, system integrators and end users. The ecosystem of the MEMS market consists of raw material suppliers for MEMS device manufacturers. The main die manufacturers include IBM Corp. (US), Elmos Semiconductor AG (Germany), TSMC, Ltd. (Taiwan), ams AG (Austria), Goertek, Inc. (China), and ON Semiconductor Corp. (US). Some of the major OEMs of the MEMS market are Analog Devices Inc. (US), Honeywell International, Inc. (US), Robert Bosch GmbH (Germany), STMicroelectronics N.V. (Switzerland), and Colibrys Ltd. (Switzerland). The system integrators include Texas Instruments, Inc. (US), Denso Corp. (Japan), Delphi Automotive PLC (UK), Aisin Seiki Co., Ltd. (Japan), Standard Motor Products, Inc. (US), HP, Inc. (US), Canon, Inc. (Japan), and Harman International Industries, Inc. (US). The end users of the MEMS market include Samsung Electronics Co., Ltd. (South Korea), Apple Inc. (US), Honda Motor Co., Ltd (Japan), General Motors (US), and Ford Motor Co. (US).

Key Target Audience:

- Raw material and manufacturing equipment suppliers

- Electronic design automation (EDA) and design tool vendors

- Original equipment manufacturers (OEMs)

- Integrated device manufacturers (IDMs)

- Original design manufacturers (ODMs)

- ODM and OEM technology solution providers

- Assembly, testing, and packaging vendors

- Technology, service, and solution providers

- Intellectual property (IP) core and licensing providers

- Suppliers and distributors

- Governments and other regulatory bodies

- Technology investors

- Research institutes and organizations

- Market research and consulting firms

The study answers several questions for the stakeholders, primarily, which market segments to focus on in the next two to five years (depends on the range of forecast period) for prioritizing the efforts and investments.

Report Scope:

In this report, the MEMS market has been segmented into the following categories in addition to the industry trends, which have also been detailed below:

- MEMS Market, by Sensor Type:

- Inertial

- Accelerometer

- Gyroscope

- Magnetometer

- Combo Sensor

- Pressure

- Microphone

- Environmental

- Optical

- Microbolometer

- Passive Infrared Sensor (PIR) and Thermopile

- Inertial

- MEMS Market, by Actuator Type:

- Optical

- Inkjet Head

- Microfluidics

- Radio Frequency (RF)

- Switch

- Filter

- Oscillator

- MEMS Market, by Vertical:

- Automotive

- Consumer Electronics

- Defense

- Industrial

- Healthcare

- Telecom

- Aerospace

- MEMS Market, by Geography:

- Americas:

- US

- Canada

- Mexico

- Brazil

- Rest of the Americas

- Europe:

- Germany

- UK

- France

- Italy

- Rest of Europe

- Asia Pacific (APAC):

- Japan

- China

- South Korea

- India

- Rest of APAC

- Rest of the World:

- Middle East

- Africa

- Americas:

- Competitive Landscape

- Company Profiles: Detailed analysis of the major companies present in the MEMS market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that provides a detailed comparison of product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five).

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Market Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.1.2.4 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Opportunities in the Overall MEMS Market

4.2 MEMS Market, By Vertical

4.3 MEMS Market, By Sensor and Actuator Types

4.4 Country-Wise Analysis of the MEMS Market

4.5 MEMS Market, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Evolution for MEMS

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Demand for Smart Consumer Electronics and Wearable Devices

5.3.1.2 Stringent Government Regulations for the Automotive Vertical

5.3.1.3 Introduction of Efficient, Economic, and Compact MEMS Technology

5.3.1.4 Huge Adoption of Automation in Industries and Homes

5.3.2 Restraints

5.3.2.1 Highly Complex Manufacturing Process and Demanding Cycle Time

5.3.2.2 Lack of Standardized Fabrication Process for MEMS

5.3.3 Opportunities

5.3.3.1 Emerging Demand for Autonomous Vehicles

5.3.3.2 Rising Demand for Connected Devices to Implement Iot

5.3.3.3 Advancement in Sensor Fusion Technology

5.3.3.4 Increasing Adoption in Healthcare Vertical

5.3.4 Challenges

5.3.4.1 Low Return on Investment

5.3.4.2 Miniaturization Leading to A High Level of Complexity

5.4 Value Chain Analysis

5.5 MEMS Players Business Model

6 MEMS Market, By Sensor Type (Page No. - 50)

6.1 Introduction

6.2 Inertial Sensor

6.2.1 Accelerometer

6.2.2 Gyroscope

6.2.3 Magnetometer

6.2.4 Combo Sensor

6.3 Pressure Sensor

6.4 Microphone

6.5 Environmental Sensor

6.6 Optical Sensor

6.6.1 Microbolometer

6.6.2 Pir & Thermophile

7 MEMS Market, By Actuator Type (Page No. - 67)

7.1 Introduction

7.2 Optical

7.3 Microfluidics

7.4 Inkjet Head

7.5 RF

7.5.1 Switch

7.5.2 Filter

7.5.3 Oscillator

8 MEMS Market, By Vertical (Page No. - 78)

8.1 Introduction

8.2 Automotive

8.3 Consumer Electronics

8.4 Defense

8.5 Aerospace

8.6 Industrial

8.7 Healthcare

8.8 Telecom

9 Geographic Analysis (Page No. - 95)

9.1 Introduction

9.2 Americas

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.2.4 Brazil

9.2.5 Rest of the Americas

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 UK

9.3.4 Italy

9.3.5 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 Japan

9.4.3 South Korea

9.4.4 India

9.4.5 Rest of APAC

9.5 RoW

9.5.1 Middle East

9.5.2 Africa

10 Competitive Landscape (Page No. - 112)

10.1 Overview

10.2 Market Ranking Analysis

10.3 Vendor Dive Overview

10.3.1 Vanguards (Leaders)

10.3.2 Dynamic

10.3.3 Innovator

10.3.4 Emerging

10.4 Business Strategy (For All 25 Players)

10.5 Product Offering (For All 25 Players)

*Top 25 Companies Analyzed for This Study are - Stmicroelectronics N.V. (Switzerland), Robert Bosch GmbH (Germany), Analog Devices, Inc. (US), NXP Semiconductors N.V. (Netherlands), Texas Instruments Inc. (US), Panasonic Corp. (Japan), Murata Manufacturing, Co., Ltd. (Japan), Invensense, Inc. (US), Infineon Technologies AG (Germany), Asahi Kasei Microdevices Corp. (Japan), Te Connectivity Corp. (Switzerland), Sensata Technologies Holding N.V. (Netherlands), Rohm Co., Ltd. (Japan), Denso Corp. (Japan), Broadcom Ltd. (US), Honeywell International Inc. (US), Knowles Corp. (US), Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan), Omron Corp. (Japan), Seiko Epson Corp. (Japan), AAC Technologies Holdings Inc. (China), Alps Electric Co., Ltd. (Japan), Amphenol Corp. (US), Utc Aerospace Systems (US), and Goertek Inc. (China).

10.6 Competitive Scenario

10.6.1 New Product Launches

10.6.2 Mergers and Acquisitions

10.6.3 Partnerships, Collaborations, and Expansions

11 Company Profiles (Page No. - 124)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

11.1 Introduction

11.2 Stmicroelectronics N.V.

11.3 Robert Bosch GmbH

11.4 Analog Devices, Inc.

11.5 NXP Semiconductors N.V.

11.6 Texas Instruments, Inc.

11.7 Panasonic Corp.

11.8 Murata Manufacturing Co., Ltd.

11.9 Invensense, Inc.

11.10 Infineon Technologies AG

11.11 Asahi Kasei Microdevices Corp.

11.12 Key Innovators

11.12.1 Rohm Co., Ltd.

11.12.2 Seiko Epson Corp.

11.12.3 Alps Electric Co., Ltd.

11.12.4 Amphenol Corp.

11.12.5 AAC Technologies Holdings, Inc.

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 163)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (65 Tables)

Table 1 Various Government Regulations for the Automotive Vertical

Table 2 MEMS Market, By Device Type, 2015–2022 (USD Million)

Table 3 MEMS Market, By Device Type, 2015–2022 (Million Units)

Table 4 MEMS Market, By Sensor Type, 2015–2022 (USD Million)

Table 5 MEMS Market, By Sensor Type, 2015–2022 (Million Units)

Table 6 MEMS Market for Sensor, By Vertical, 2015–2022 (USD Million)

Table 7 MEMS Market, By Inertial Sensor Type, 2015–2022 (USD Million)

Table 8 MEMS Market for Inertial Sensor, By Vertical, 2015–2022 (USD Million)

Table 9 MEMS Market for Accelerometer, By Vertical, 2015–2022 (USD Million)

Table 10 MEMS Market for Gyroscope, By Vertical, 2015–2022 (USD Million)

Table 11 MEMS Market for Magnetometer, By Vertical, 2015–2022 (USD Million)

Table 12 MEMS Market for Combo Sensor, By Vertical, 2015–2022 (USD Million)

Table 13 MEMS Market for Pressure Sensor, By Vertical, 2015–2022 (USD Million)

Table 14 MEMS Market for Microphone, By Vertical, 2015–2022 (USD Million)

Table 15 MEMS Market for Environmental Sensor, By Vertical, 2015–2022 (USD Million)

Table 16 MEMS Market, By Optical Sensor Type, 2015–2022 (USD Million)

Table 17 MEMS Market for Optical Sensor, By Vertical, 2015–2022 (USD Million)

Table 18 MEMS Market for Micro Bolometer, By Vertical, 2015–2022 (USD Million)

Table 19 MEMS Market for Pir & Thermopiles, By Vertical, 2015–2022 (USD Million)

Table 20 MEMS Market, By Actuator Type, 2015–2022 (USD Million)

Table 21 MEMS Market, By Actuator Type, 2015–2022 (Million Units)

Table 22 MEMS Market for Actuator, By Vertical, 2015–2022 (USD Million)

Table 23 MEMS Market for Optical Actuator, By Vertical, 2015–2022 (USD Million)

Table 24 MEMS Market for Microfluidics, By Vertical, 2015–2022 (USD Million)

Table 25 MEMS Market for Inkjet Head, By Vertical, 2015–2022 (USD Million)

Table 26 MEMS Market, By RF Actuator Type, 2015–2022 (USD Million)

Table 27 MEMS Market for RF Actuator, By Vertical, 2015–2022 (USD Million)

Table 28 MEMS Market for RF Switch, By Vertical, 2015–2022 (USD Million)

Table 29 MEMS Market for RF Filter, By Vertical, 2015–2022 (USD Million)

Table 30 MEMS Market for Oscillator, By Vertical, 2015–2022 (USD Million)

Table 31 MEMS Market, By Vertical, 2015–2022 (USD Million)

Table 32 MEMS Market for Automotive, By Sensor Type, 2015–2022 (USD Million)

Table 33 MEMS Market for Automotive, By Actuator Type, 2015–2022 (USD Million)

Table 34 MEMS Market for Automotive, By Region, 2015–2022 (USD Million)

Table 35 MEMS Market for Consumer Electronics, By Sensor Type, 2015–2022 (USD Million)

Table 36 MEMS Market for Consumer Electronics, By Actuator Type, 2015–2022 (USD Million)

Table 37 MEMS Market for Consumer Electronics, By Region, 2015–2022 (USD Million)

Table 38 MEMS Market for Defense, By Sensor Type, 2015–2022 (USD Million)

Table 39 MEMS Market for Defense, By Actuator Type, 2015–2022 (USD Million)

Table 40 MEMS Market for Defense, By Region, 2015–2022 (USD Million)

Table 41 MEMS Market for Aerospace, By Sensor Type, 2015–2022 (USD Million)

Table 42 MEMS Market for Aerospace, By Actuator Type, 2015–2022 (USD Million)

Table 43 MEMS Market for Aerospace, By Region, 2015–2022 (USD Million)

Table 44 MEMS Market for Industrial, By Sensor Type, 2015–2022 (USD Million)

Table 45 MEMS Market for Industrial, By Actuator Type, 2015–2022 (USD Million)

Table 46 MEMS Market for Industrial, By Region, 2015–2022 (USD Million)

Table 47 MEMS Market for Healthcare, By Sensor Type, 2015–2022 (USD Million)

Table 48 MEMS Market for Healthcare, By Actuator Type, 2015–2022 (USD Million)

Table 49 MEMS Market for Healthcare, By Region, 2015–2022 (USD Million)

Table 50 MEMS Market for Telecom, By Sensor Type, 2015–2022 (USD Million)

Table 51 MEMS Market for Telecom, By Actuator Type, 2015–2022 (USD Million)

Table 52 MEMS Market for Telecom, By Region, 2015–2022 (USD Million)

Table 53 MEMS Market, By Region, 2015–2022 (USD Million)

Table 54 MEMS Market in Americas, By Country, 2015–2022 (USD Million)

Table 55 MEMS Market in Americas, By Vertical, 2015–2022 (USD Million)

Table 56 MEMS Market in Europe, By Country, 2015–2022 (USD Million)

Table 57 MEMS Market in Europe, By Vertical, 2015–2022 (USD Million)

Table 58 MEMS Market in APAC, By Country, 2015–2022 (USD Million)

Table 59 MEMS Market in APAC, By Vertical, 2015–2022 (USD Million)

Table 60 MEMS Market in RoW, By Region, 2015–2022 (USD Million)

Table 61 MEMS Market in RoW, By Vertical, 2015–2022 (USD Million)

Table 62 Market Ranking of Top 10 Players in the MEMS Market, 2016

Table 63 25 Most Recent New Product Launches in the MEMS Market

Table 64 10 Most Recent Mergers and Acquisitions in the MEMS Market

Table 65 10 Most Recent Partnerships, Collaborations, and Expansions in the MEMS Market

List of Figures (47 Figures)

Figure 1 MEMS Market: Research Design

Figure 2 Process Flow of Market Size Estimation

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Inertial Sensor to Hold the Largest Share of the MEMS Market During the Forecast Period

Figure 8 The RF MEMS Actuator Held the Major Share of the MEMS Market in 2016

Figure 9 Consumer Electronics, Automotive, Industrial, and Healthcare are the Four Most Promising Verticals of the MEMS Market

Figure 10 APAC Expected to Be the Fastest-Growing Region in the MEMS Market During the Forecast Period

Figure 11 Growing Demand for Smart Consumer Electronics and Wearable Devices is Driving the Growth of the MEMS Market

Figure 12 Top 3 Verticals Hold Almost 90 Percent Share of the Overall MEMS Market Throughout the Forecast Period

Figure 13 Inertial Sensor and RF Actuator Hold the Highest Market Share

Figure 14 US Accounted for the Largest Share of the MEMS Market in 2017

Figure 15 MEMS Market in APAC is Expected to Grow at the Highest Rate During the Forecast Period

Figure 16 Growing Demand for Smart Consumer Electronics and Wearable Devices and Stringent Government Regulations for the Automotive Vertical are Going to Drive the Growth of the MEMS Market

Figure 17 Total Smartphone Users in the World (2013–2020)

Figure 18 Number of Connected Devices to Reach Approximately 50 Billion By 2020: Cisco Perspective

Figure 19 Increasing Penetration Rate of Connected Objects (2012–2020)

Figure 20 Value Chain Analysis: Major Value Added During the Raw Material Supply and Original Equipment Manufacturing Phase

Figure 21 Sensor Type to Hold the Largest Share of the MEMS Market During the Forecast Period

Figure 22 Inertial Sensor to Hold the Largest Share of the MEMS Market for Sensor Type During the Forecast Period

Figure 23 Combo Sensor to Be the Fastest Growing MEMS Inertial Sensor During the Forecast Period

Figure 24 Pir and Thermophile to Be the Fastest Growing MEMS Optical Sensor During the Forecast Period

Figure 25 RF to Be the Fastest Growing MEMS Actuator During the Forecast Period

Figure 26 Oscillator to Be the Fastest Growing RF Actuator During the Forecast Period

Figure 27 Healthcare to Be the Fastest Growing Vertical in the MEMS Market During the Forecast Period

Figure 28 MEMS Market: Geographic Snapshot

Figure 29 Americas: MEMS Market Snapshot

Figure 30 Europe: MEMS Market Snapshot

Figure 31 Asia Pacific: MEMS Market Snapshot

Figure 32 RoW: MEMS Market Snapshot

Figure 33 Companies in the MEMS Market Adopted New Product Launches as the Key Growth Strategy Between January 2014 and March 2017

Figure 34 Dive Chart

Figure 35 MEMS Market Evaluation Framework

Figure 36 Battle for the Market Share

Figure 37 Geographic Revenue Mix for Major Market Players

Figure 38 Stmicroelectronics N.V. : Company Snapshot

Figure 39 Robert Bosch GmbH.: Company Snapshot

Figure 40 Analog Devices, Inc.: Company Snapshot

Figure 41 NXP Semiconductors N.V.: Company Snapshot

Figure 42 Texas Instruments, Inc.: Company Snapshot

Figure 43 Panasonic Corp.: Company Snapshot

Figure 44 Murata Manufacturing Co., Ltd.: Company Snapshot

Figure 45 Invensense, Inc.: Company Snapshot

Figure 46 Infineon Technologies AG: Company Snapshot

Figure 47 Asahi Kasei Microdevices Corp.: Company Snapshot