Feed Pigment Market - Global Trends & Forecasts to 2020

The pigments in feed market is estimated to be valued at USD 946.08 million in 2015. The market is projected to grow at a CAGR of 3.2% from 2015 to 2020. The pigments in feed market is segmented on the basis of type, livestock, and source. It is further segmented on the basis of region into North America, Europe, Asia-Pacific, Latin America, and the Rest of the World (RoW). With the increasing meat consumption and health benefits, the use of carotenoid pigments in animal feed is expected to enhance the market growth.

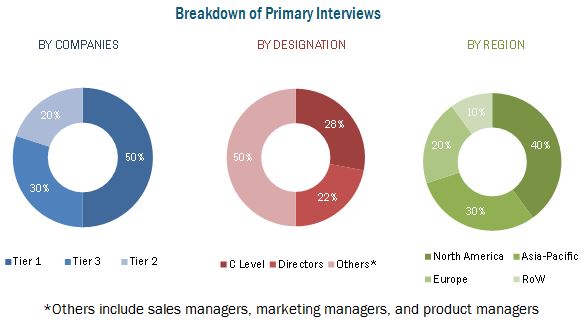

This report includes estimation of market size for value (USD million) and volume (KT). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global pigments in feed market and to estimate the size of various other dependent submarkets. Key players in the market have been identified through secondary research, and their market share in their respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

This report provides both qualitative and quantitative analyses of the pigments in feed market, the competitive landscape, and the preferred development strategies of key players. The key players preferred new product development, expansions, and acquisitions as preferred strategies to gain a larger share in the market. It also analyzes the market dynamics and issues faced by leading players.

The target audience for the report includes:

- Feed pigment raw material suppliers

- Feed pigment importers & exporters

- Animal feed additives manufacturers and distributors

- Research institutions

- Consumers engaged in animal farming and aquaculture business

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the Report

On the basis of Type, the pigments in feed market is segmented as follows:

- Carotenoids

- Beta-Carotene

- Lutein

- Lycopene

- Astaxanthin

- Zeaxanthin

- Curcumin

- Caramel

- Spirulina

- Others (riboflavin, betalain, vegetable black, and anthocyanins)

On the basis of Livestock, the pigments in feed market is segmented as follows:

- Swine

- Ruminants

- Poultry

- Aquatic animals

- Others (equines, sheep, and birds)

On the basis of Source, the pigments in feed market is segmented as follows:

- Natural pigments in feed

- Synthetic pigments in feed

On the basis of Region, the pigments in feed market is segmented as follows:

- North America

- Europe

- Asia-Pacific

- Latin America

- RoW (South Africa and the Middle East)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered in the Report

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Growing Livestock Population

2.2.2.2 Increasing Demand for Milk and Meat Products

2.2.2.3 Parent Market Analysis: Animal Feed Industry

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

2.5.1 Assumptions

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 38)

4.1 Attractive Opportunities in this Market

4.2 Carotenoids: Leading Segment By Type

4.3 Feed Pigments Market: 2015-2020 (USD Million)

4.4 Europe: Largest Feed Pigments Market

4.5 Carotenoids: Fastest-Growing Feed Pigments Market

4.6 Poultry: Dominating Segment in Feed Pigments Market, By Livestock

4.7 Synthetic: Largest Segment in the Feed Pigments Market, By Source

4.8 Life Cycle Analysis: By Region

5 Market Overview (Page No. - 46)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Health Benefits of Carotenoids for Animals

5.4.1.2 Rising Consumption of Meat

5.4.1.3 Industrialization of Pork, Poultry, and Aquaculture Businesses

5.4.1.4 Increasing Preference Towards Pellet Feed

5.4.2 Restraints

5.4.2.1 Regulatory Aspects

5.4.2.2 Rising Cost of Raw Materials

5.4.3 Opportunities

5.4.3.1 Growing Asia-Pacific Market

5.4.3.2 Aquaculture and Feed Pigments

5.4.4 Challenges

5.4.4.1 Adulteration

6 Industry Trends (Page No. - 58)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Prominent Companies

6.3.2 Small & Medium Enterprises

6.3.3 End Users/Consumers

6.4 Porter’s Five Forces Analysis

6.4.1 Intensity of Competitive Rivalry

6.4.2 Bargaining Power of Suppliers

6.4.3 Bargaining Power of Buyers

6.4.4 Threat of New Entrants

6.4.5 Threat of Substitutes

7 Feed Pigments Market, By Type (Page No. - 65)

7.1 Introduction

7.2 Carotenoids

7.2.1 Beta-Carotene

7.2.2 Lutein

7.2.3 Lycopene

7.2.4 Astaxanthin

7.2.5 Zeaxanthin

7.2.6 Canthaxanthin

7.2.7 Other Carotenoids

7.3 Curcumin

7.4 Caramel

7.5 Spirulina

7.6 Other Feed Pigments

8 Feed Pigments Market, By Carotenoids Source (Page No. - 79)

8.1 Introduction

8.2 Natural Feed Pigments

8.3 Synthetic Feed Pigments

9 Feed Pigments Market, By Livestock (Page No. - 85)

9.1 Introduction

9.2 Swine

9.3 Poultry

9.4 Ruminants

9.5 Aquatic Animals

9.6 Feed Pigments for Other Livestock Types

10 Feed Pigments Market, By Region (Page No. - 94)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Italy

10.3.4 the Netherlands

10.3.5 Spain

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 Indonesia

10.4.5 Rest of Asia-Pacific

10.5 Latin America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of Latin America

10.6 Rest of the World

10.6.1 South Africa

10.6.2 Others in RoW

11 Competitive Landscape (Page No. - 139)

11.1 Overview

11.2 Competitive Situation & Trends

11.3 Expansions

11.4 Acquisitions

11.5 New Product Launches

11.6 Partnerships & Collaborations

12 Company Profiles (Page No. - 147)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 BASF SE

12.3 Royal DSM N.V.

12.4 Kemin Industries Inc.

12.5 Novus International, Inc.

12.6 Guangzhou Leader Bio-Technology Co., Ltd

12.7 D.D. Williamson & Co., Inc.

12.8 Nutrex NV

12.9 Behn Meyer Group

12.10 Vitafor NV

12.11 Innovad AD NV/SA

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 172)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Company Developments

13.3.1 New Product Launches/Developments

13.3.2 Partnerships & Collaborations

13.3.3 Acquisitions

13.3.4 Expansions

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports