E-bike Market by Class, Battery Type (Lithium-ion, Lithium-ion polymer, Lead Acid), Motor Type (Mid, Hub), Mode (Throttle, Pedal Assist), Usage, and Region (Asia Pacific, Europe, North America) - Global forecast to 2025

Class-I electric bike is expected to be the largest segment during the forecast period

Class-I electric bike is anticipated to be the largest segment of the e-bike market. Class-I electric bike provides assistance only when the rider is pedaling and stops providing assistance when the bicycle reaches 20 mph. This type of electric bike can operate on any paved surface. Also, class-I electric bike are compatible with electric bike laws of most of the countries. Thus, class-I electric bike are expected to hold the largest market share during the forecast period.

Class-III segment is expected to grow at the fastest rate during the forecast period

Class-III electric two wheeler segment is likely to be the fastest growing segment of the global market. A class-III electric bike, which is also known as speed pedal-assisted electric bicycle, provides assistance only when the rider is pedaling and stops providing assistance when the bicycle reaches 28 mph. These electric bike are allowed on roads, adjacent bike lanes, or private property due to their higher speed than the other two classes, i.e. class-I and class-II. These electric bike are expected to help replace cars and reduce traffic congestion. Hence, this electric bike segment is expected to be the fastest growing market during the forecast period.

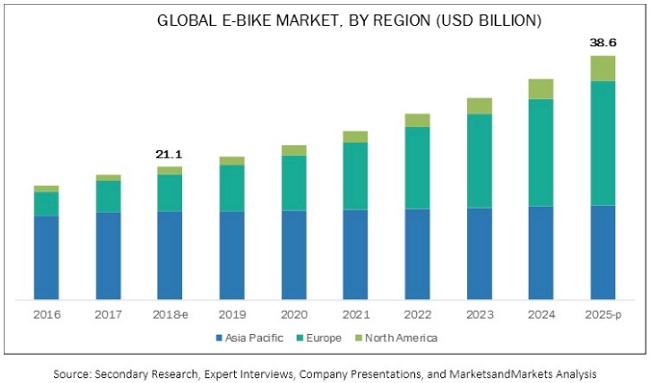

Asia Pacific is expected to account for the largest market size during the forecast period

The Asia Pacific region is estimated to be the largest e-bike market by 2025. The region comprises some of the fastest developing economies of the world such as China and India. The governments of these developing economies have recognized the growth potential of electric two-wheelers and, hence, have taken several initiatives to attract major OEMs to manufacture electric two-wheelers in their domestic markets. For instance, the Government of India announced financial support and a scheme called Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME). Under the scheme, there is a subsidy of up to INR 22,000 for electric scooters/electric bikes. Government promotions and schemes have led to an increase in sales of electric two-wheelers over the years.

The governments of many countries in the Asia Pacific region are focusing on electric two wheelers. For instance, China’s electric bikes have gained popularity in the European market due to their good quality and technological edge.

E-Bike Market Key Players

The major market players include Yamaha Motor Corporation (Japan), Giant Manufacturing Co., Ltd (Taiwan), Accell Group N.V (Netherlands), Aima Technology Group Co., Ltd (China), and Yadea Group Holdings Ltd (China). These companies have strong distribution networks at the global level. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements. For instance, in October 2016, Giant Bicycle partnered with financial services player Affirm. Through the tie-up, Giant’s shoppers can pay for their bicycle purchases over time with Affirm. The company added this payment flexibility to its website for online buyers.

E-bikes Market Recent Developments

- In July 2018, Yamaha introduced 600Wh multi-location in tube battery for Electrically Power Assisted Bicycles (EPACs), which offer a 20% capacity increase.

- In June 2018, Yamaha Motor Corporation introduced the PW series TE system (Quadra sensor System). This provides an automatic support mode in which the motor delivers appropriate power for every particular mode of driving.

- In June 2016, Accell Group N.V. introduced a new product Sparta M8i and the Haibike eConnect in 2016. It was the first addition of connected bicycle models to the portfolio. Sparta (Accell Brand) and Conneqtech partnered to develop the software to allow the Track&Trace system to communicate using the Internet. Haibike eConnect is developed by Haibike for certain sDuro 8.0 models, which links eBike to the digital world with the help of a GPS control module inside the bike.

- In October 2015, Yadea Group Holdings Ltd partnered with Gi FlyBike to produce an innovative smart bike in China and make the complex design of the FlyBike a reality.

- In December 2015, AIMA Technology Group Co. Ltd. launched the AIMA flagship store in Switzerland as it continued to promote the reputation, popularity, and loyalty of its brand, and finally increase its brand influence worldwide.

Critical Questions in E-bike Market:

- How will the trend of class-III electric bike sales impact the market in the long term?

- How will the industry cope with the Electric two wheeler battery challenges?

- How do you see the impact of government safety regulations in the market?

- What are the upcoming trends in the e-bike market? What impact would they make post 2025?

- What are the key strategies adopted by top players to increase their revenue?

1 Introduction (Page No. - 15)

1.1 Objectives of the Study - E-bike Market

1.2 Product and Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency Exchange Rates

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.5 Market Breakdown and Data Triangulation

2.6 Research Assumptions and Limitations

2.6.1 Assumptions

2.6.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Global E-Bike Market

4.2 Asia Pacific Leads the global Market in 2018

4.3 Market, By Class

4.4 Market, By Battery Type

4.5 Market, By Motor Type

4.6 Market, By Mode

4.7 Market, By Usage

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Concerns About Traffic Congestion

5.2.1.2 Rapid Urbanization

5.2.1.3 Government Initiatives to Reduce Emission Level

5.2.1.4 Growing Bicycle Tourism Industry

5.2.2 Restraints

5.2.2.1 Underdeveloped Aftermarket Services

5.2.2.2 Technological Challenges

5.2.2.3 Unplanned Infrastructure in Developing Countries

5.2.3 Opportunities

5.2.3.1 Government Initiatives to Regulate electric bikes & Improve Infrastructure for electric bikes

5.2.3.2 Bike Sharing

5.2.4 Challenges

5.2.4.1 Limited Distribution Channels

5.2.4.2 Misconstrued Perception About Cycling

6 Industry Trends (Page No. - 41)

6.1 Technology Overview

6.1.1 Introduction

6.1.2 Motor Drive Technology

6.1.3 Battery Technology

6.2 Regulatory Overview

6.3 Porter’s Five Forces

7 E-Bike Market, By Class (Page No. - 48)

7.1 Introduction

7.2 Class-I

7.2.1 Class-I Segment Complies With the E-Bike Laws and Regulations of Many Countries

7.3 Class-Ii

7.3.1 Reasonable Prices Will Drive Growth Opportunities for the Class-Ii Segment in North America

7.4 Class-Iii

7.4.1 Class-Iii Segment is Expected to Be A Potential Solution for Car Replacement; Hence It is the Fastest Growing Market Among All Categories

8 E-Bike Market, By Battery Type (Page No. - 53)

8.1 Introduction

8.2 Lithium-Ion

8.2.1 Oem Shift Toward Lightweight Bikes Will Boost the Demand for Lithium-Ion Batteries During the Forecast Period

8.3 Lithium-Ion Polymer

8.3.1 Increase in Demand for Lightweight Bikes and Improved Safety Will Drive the Growth of Lithium-Ion Polymer Batteries During the Forecast Period

8.4 Lead Acid

8.4.1 Technological Limitations are Expected to Decrease the Sales of Lead Acid Batteries During the Forecast Period

8.5 Others

8.5.1 Adoption of Solid-State Batteries Could Provide Growth Opportunities for the Segment

9 E-Bike Market, By Motor Type (Page No. - 59)

9.1 Introduction

9.2 Hub Motor

9.2.1 Shift in Interests of electric bike Oems Towards Lightweighting Will Decrease the Growth of Hub Motors During the Forecast Period (2018–2025)

9.3 Mid Motor

9.3.1 Increase in Demand for Lightweight and Better Quality electric bike Will Boost the Demand for Mid Motors Segment

10 E-Bike Market, By Mode (Page No. - 63)

10.1 Introduction

10.2 Pedal Assist Mode

10.2.1 Pedal Assist Mode Abides By the electric bike Laws and Regulations of Most Countries Across the Globe, Which Will Help Boost Its Demand During the Forecast Period

10.3 Throttle Mode

10.3.1 Throttle Type electric two wheelers Segment is Expected to Witness Negative Growth Owing to Incompatibility With E-Bike Laws and Regulations of Many Countries

11 E-Bike Market, By Region (Page No. - 67)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.1.1 Market Saturation and Selective Bans Play Spoilsport in China

11.2.2 Japan

11.2.2.1 Japan on Track to Remain Second-Largest Market in Asia

11.2.3 Taiwan

11.2.3.1 Taiwanese Market to Post Double-Digit Growth Despite Shrinking Demand of Mountain Bikes

11.2.4 South Korea

11.2.4.1 South Korea to Be the Fastest Growing Market in Asia

11.2.5 India

11.2.5.1 All Usage Applications to Expand in India

11.3 Europe

11.3.1 Germany

11.3.1.1 Despite Slowing Growth, Germany to Retain Regional; Leadership in Europe

11.3.2 The Netherlands

11.3.2.1 Saturation Leading to Slower Growth in the Netherlands

11.3.3 Belgium

11.3.3.1 Tax Benefits, Tourism to Boost Demand of electric bikes in Belgium

11.3.4 France

11.3.4.1 Policy Tailwinds to Make France the Fastest Growing Market in Europe

11.3.5 Italy

11.3.5.1 All Usage Applications to Post Double-Digit Growth Rates in Italy

11.3.6 Rest of Europe (RoE)

11.3.6.1 RoE Market to Expand in Line With Europe

11.4 North America

11.4.1 Canada

11.4.1.1 Canada to Be the Fastest Expanding E-Bike Market in North America

11.4.2 US

11.4.2.1 Secular Demand Trends to Help United States in Posting Double-Digit CAGR

12 Competitive Landscape (Page No. - 87)

12.1 electric bike Manufacturers

12.1.1 Overview

12.1.2 E-Bike Market Ranking Analysis

12.1.3 Competitive Scenario

12.1.3.1 Contracts & Agreements

12.1.3.2 New Product Developments

12.1.3.3 Expansions

12.1.3.4 Mergers & Acquisitions

12.1.4 Competitive Leadership Mapping

12.1.4.1 Visionary Leaders

12.1.4.2 Innovators

12.1.4.3 Dynamic Differentiators

12.1.4.4 Emerging Companies

12.2 Component Suppliers

12.2.1 Overview

12.2.2 E-Bike Component Suppliers: Market Ranking Analysis

12.2.3 Competitive Scenario

12.2.3.1 Contracts & Agreements

12.2.3.2 New Product Developments

12.2.3.3 Expansions

12.2.3.4 Mergers & Acquisitions

12.2.4 Competitive Leadership Mapping

12.2.4.1 Visionary Leaders

12.2.4.2 Innovators

12.2.4.3 Dynamic Differentiators

12.2.4.4 Emerging Companies

13 Company Profiles (Page No. - 104)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 E-bike Market Manufacturers

13.1.1 Yamaha Motor Company

13.1.2 Giant Manufacturing Co. Ltd.

13.1.3 Accell Group N.V.

13.1.4 Aima Technology Group Co. Ltd.

13.1.5 Yadea Group Holdings Ltd

13.1.6 Pedego Electric Bikes

13.1.7 Merida Industry Co. Ltd

13.1.8 Trek Bicycle Corporation

13.1.9 Specialized Bicycle Components, Inc.

13.2 Component Suppliers

13.2.1 Robert Bosch GmbH

13.2.2 Samsung SDI Co. Ltd.

13.2.3 Continental AG

13.2.4 Panasonic Corporation

13.2.5 LG Chem Ltd

13.2.6 Johnson Matthey Battery Systems

13.2.7 Shimano

13.2.8 BMZ GmbH

13.2.9 Brose Fahrzeugteile

*Details on E-bike Market Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies

14 Appendix (Page No. - 139)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.3.1 Additional Company Profiles

14.3.1.1 Business Overview

14.3.1.2 SWOT Analysis

14.3.1.3 Recent Developments

14.3.1.4 MnM View

14.3.1.5 Who–Supplies–Whom Data

14.3.2 Region and Country Specific E-Bike Market, By Value and Volume

14.4 Related Reports

14.5 Author Details

List of Tables (52 Tables)

Table 1 Currency Exchange Rates (WRT USD)

Table 2 Technology Developments in E-Bike: 1881–2018

Table 3 Electric Bikes Regulation in Europe

Table 4 Regulation in US

Table 5 Regulation in Asia

Table 6 Regulation in Asia (Taiwan)

Table 7 Regulation in Asia (China)

Table 8 Regulation in Asia (India)

Table 9 E-Bike Market, By Class, 2016–2025 (Units)

Table 10 Class-I: Market, By Region, 2016–2025 (Units)

Table 11 Class-Ii: Market, By Region, 2016–2025 (Units)

Table 12 Class-Iii: Market, By Region, 2016–2025 (Units)

Table 13 E-Bike Market, By Battery Type, 2016–2025 (Units)

Table 14 Lithium-Ion Battery: Market, By Region, 2016–2025 (Units)

Table 15 Lithium-Ion Polymer Battery: Market, By Region, 2016–2025 (Units)

Table 16 Lead Acid Battery: Market, By Region, 2016–2025 (Units)

Table 17 Others: Market, By Region, 2016–2025 (Units)

Table 18 Market, By Motor Type, 2016–2025 (Units)

Table 19 Hub Motor: Market, By Region, 2016–2025 (Units)

Table 20 Mid Motor: Market, By Region, 2016–2025 (Units)

Table 21 Market, By Mode, 2016–2025 (Units)

Table 22 Pedal Assist Type: Market, By Region, 2016–2025 (Units)

Table 23 Throttle Type: Market, By Region, 2016–2025 (Units)

Table 24 Market, By Region, 2016–2025 (Units)

Table 25 Market, By Region, 2016–2025 (USD Billion)

Table 26 Asia Pacific: Market, By Country, 2016–2025 (Units)

Table 27 Asia Pacific: Market, By Country, 2016–2025 (USD Billion)

Table 28 China: E-bike Market, By Usage, 2016–2025 (Units)

Table 29 Japan: Market, By Usage, 2016–2025 (Units)

Table 30 Taiwan: Market, By Usage, 2016–2025 (Units)

Table 31 South Korea: Market, By Usage, 2016–2025 (Units)

Table 32 India: Market, By Usage, 2016–2025 (Units)

Table 33 Europe: Market, By Country, 2016–2025 (Units)

Table 34 Europe: Market, By Country, 2016–2025 (USD Billion)

Table 35 Germany: Market, By Usage, 2016–2025 (Units)

Table 36 The Netherlands: Market, By Usage, 2016–2025 (Units)

Table 37 Belgium: Market, By Usage, 2016–2025 (Units)

Table 38 France: Market, By Usage, 2016–2025 (Units)

Table 39 Italy: Market, By Usage, 2016–2025 (Units)

Table 40 RoE: Market, By Usage, 2016–2025 (Units)

Table 41 North America: Market, By Country, 2016–2025 (Units)

Table 42 North America: Market, By Country, 2016–2025 (USD Billion)

Table 43 Canada: Market, By Usage, 2016–2025 (Units)

Table 44 US: Market, By Usage, 2016–2025 (Units)

Table 45 Contracts & Agreements, 2015–2018

Table 46 New Product Developments, 2015–2018

Table 47 Expansions, 2015–2018

Table 48 Mergers & Acquisitions, 2015–2018

Table 49 Contracts & Agreements, 2015–2018

Table 50 New Product Developments, 2015–2018

Table 51 Expansions, 2015–2018

Table 52 Mergers & Acquisitions, 2015–2018

List of Figures (44 Figures)

Figure 1 E-Bike Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market: Bottom-Up Approach

Figure 6 Data Triangulation

Figure 7 Global Market: Market Dynamics

Figure 8 Market, By Region, 2018–2025 (USD Billion)

Figure 9 Market, By Class, 2018 vs 2025 (Million Units)

Figure 10 Increasing Concerns About Vehicle Emission and Traffic Congestion Will Drive the Market During the Forecast Period

Figure 11 E-Bike Market Share, By Region, 2025 (USD Billion)

Figure 12 Class I Segment to Hold the Largest Market Share, 2018 vs 2025 (Units)

Figure 13 Lithium Ion Battery is Expected to Hold the Largest Market Share By 2025 (Units)

Figure 14 Hub Motor to Hold the Largest Market Share, 2018 vs 2025 (Units)

Figure 15 Pedal Assist to Hold the Largest Market Share, 2018 vs 2025 (Units)

Figure 16 City/Urban Bikes to Hold the Largest Market Share, 2018 vs 2025 (Units)

Figure 17 Market: Market Dynamics

Figure 18 Porter’s Five Forces: Automotive Software Market

Figure 19 Class-I Segment is Estimated to Lead the Market During the Forecast Period (2018–2025)

Figure 20 Lithium-Ion Battery is Estimated to Lead the Market During the Forecast Period (Units)

Figure 21 Mid Motor Segment is Expected to Grow at A Higher CAGR During the Forecast Period (2018–2025)

Figure 22 Pedal Assist Mode is Estimated to Lead the Market During the Forecast Period (Units)

Figure 23 Asia Pacific is Expected to Dominate the Market During the Forecast Period

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Europe: E-Bike Market Snapshot

Figure 26 North America: Market Snapshot (2018)

Figure 27 Companies Adopted Expansions as the Key Growth Strategy, 2015–2018

Figure 28 Market Ranking Analysis, 2016

Figure 29 Electric Bike Competitive Mapping, 2018

Figure 30 Companies Adopted Expansions as the Key Growth Strategy, 2015–2018

Figure 31 E-Bike Market Ranking Analysis, 2016

Figure 32 Electric Bike Component Suppliers Competitive Mapping, 2018

Figure 33 Yamaha Motor Company: Company Snapshot

Figure 34 Giant Manufacturing Co. Ltd.: Company Snapshot

Figure 35 Accell Group N.V.: Company Snapshot

Figure 36 Yadea Group Holdings Ltd: Company Snapshot

Figure 37 Merida Industry Co. Ltd: Company Snapshot

Figure 38 Robert Bosch GmbH: Company Snapshot

Figure 39 Samsung SDI Co. Ltd.: Company Snapshot

Figure 40 Continental AG: Company Snapshot

Figure 41 Panasonic Corporation: Company Snapshot

Figure 42 LG Chem Ltd: Company Snapshot

Figure 43 Johnson Matthey Battery Systems: Company Snapshot

Figure 44 Shimano : Company Snapshot