Speech and Voice Recognition Market by Technology (Speech and Voice Recognition), Vertical (Automotive, Consumer, Government, Enterprise, Healthcare, BFSI), Deployment (On Cloud & On-Premises/Embedded), and Geography - Global Forecast to 2024

Market for voice recognition to grow at higher CAGR during the forecast period

As compared to speech recognition, the voice recognition market is expected to grow at a higher rate from 2018 to 2024 owing to the growing use of voice recognition in multifactor authentication systems in BFSI, government, and defense verticals. In North America and Western Europe, a large number of banking customers use phone banking facilities. Many of these financial institutions are adopting voice-based authentication solutions to accept or reject mobile transactions by a user. Furthermore, the market for the voice recognition technology is expected to witness high in the government, finance, and enterprise verticals during the next 2–3 years. The data security concerns due to cyberattacks, data breaches by intruders, and issues related to illegal migrants are some of the major factors contributing to the high growth of the voice recognition market.

On-cloud deployment mode is expected to hold a larger share of the speech and voice recognition market throughout the forecast period.

Cloud-based solutions help organizations reduce CAPEX and OPEX, allowing them to achieve a considerably high level of efficiency at minimal cost. Thus, the high market share of cloud is attributed to the ability of the cloud infrastructure to provide self-service applications at a minimal cost.

Americas is likely to continue to hold the largest market share during the forecast period

The global speech and voice recognition market is dominated by the Americas owing to the large number of voice biometric systems deployed to ensure high level of security along with the proliferation of speech technologies in consumer electronics and enterprises. This region is at the forefront in terms of implementing biometric systems for improving the safety measures and security. The strong economy of the US is the major driving factor for the growth of the speech and voice recognition market in the Americas.

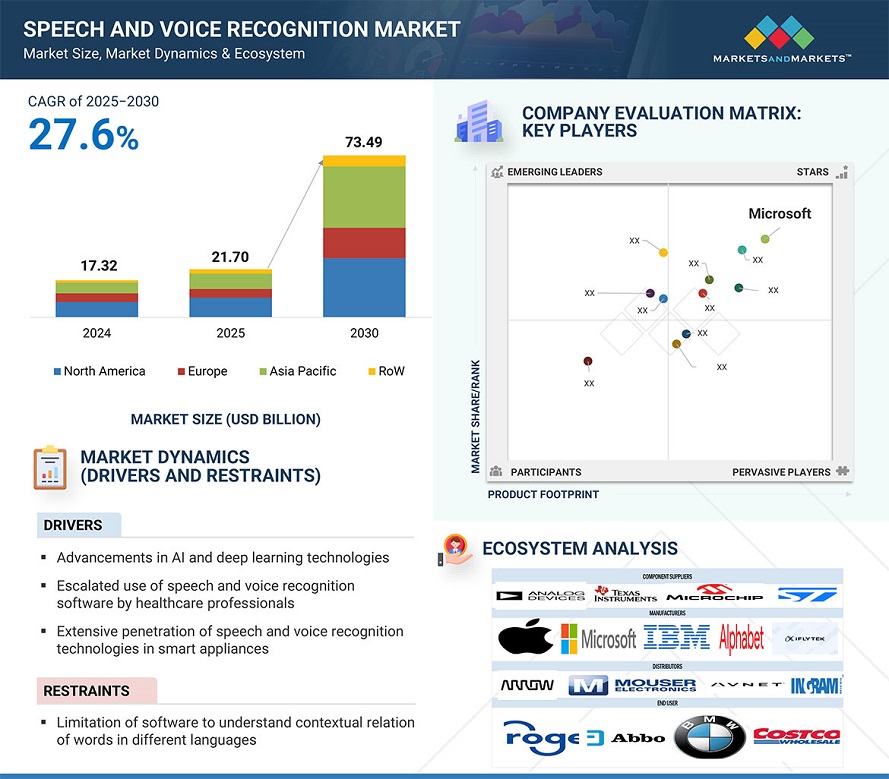

Key Market Players

Nuance (US), Microsoft (US), Alphabet (US), IBM (US), Amazon (US), Sensory (US), Cantab Research (UK), iflytek (China), Baidu (China), and Raytheon BBN Technologies (US) are a few major players in the speech and voice recognition market.

Nuance Communications (US) focuses on agreements, partnerships, and collaborations to maintain its market presence globally. The company has a huge customer base with long-term contracts. Nuance Communications has invested heavily in research and development to enhance its product portfolio and to build a world-class portfolio of intellectual property, technologies, applications, and solutions through internal developments and acquisitions. It is expected to pursue opportunities to expand its assets, geographic presence, distribution network, and customer base through acquisitions of other businesses and technologies. In the healthcare segment, Nuance Communications focuses on providing customers deeper integration with its clinical documentation solutions, investing in cloud-based products and operations, entering new and adjacent markets such as ambulatory care, and expanding global capabilities.

Recent Developments

- Nuance Communications, in May 2018, launched the universal cloud-based speech recognition platform, Dragon Medical One. Dragon Medical One brings the power of speech directly to electronic health records (EHRs), enabling physicians to quickly and conveniently capture a patient’s complete story at the point of care.

- Microsoft partnered with Toyota Motor Corporation (Japan) to enable voice recognition technology in the cars. Microsoft will provide access to its intellectual properties including operating systems, voice recognition technology, artificial intelligence, and gesture control.

- Nuance and IBM have entered into a licensing and technical services agreement to enhance and expand innovative speech solutions designed to better serve enterprises, consumers, carriers, and partners. Under this agreement, Nuance incorporates IBM technology into its speech solutions.

Critical questions the report answers:

- Where will all the developments take the industry in the mid to long term?

- What are the verticals that are expected to drive the speech and voice recognition market?

- What are the key strategies adopted by leading companies in the speech and voice recognition market?

- What are the trends prevalent in the speech and voice recognition market?

- What will be the penetration rate of speech and voice recognition in automotive vertical?

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

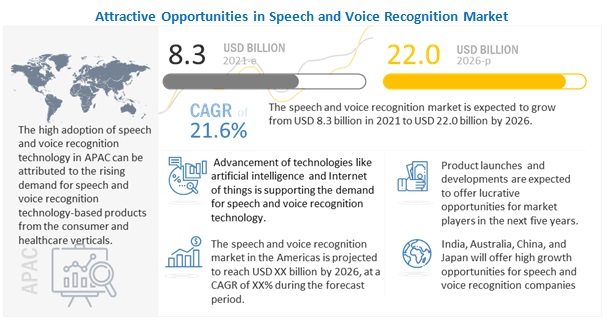

4.1 Attractive Opportunities in Speech and Voice Recognition Market

4.2 Speech and Voice Recognition Market, By Technology

4.3 Speech Recognition Market, By Type, 2018–2024

4.4 Speech and Voice Recognition, By Vertical and Country in APAC

4.5 Speech and Voice Recognition Market, By Geography

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rapid Proliferation of Multifunctional Devices Or Smart Speakers

5.2.1.2 High Growth Potential in Healthcare Application

5.2.1.3 Increased Demand for Speech-Based Biometric Systems for Multifactor Authentication

5.2.1.4 Growing Demand for Voice Authentication in Mobile Banking Applications

5.2.1.5 Growing Impact of Artificial Intelligence(AI) on the Accuracy of Speech and Voice Recognition

5.2.1.6 Growth in the Number of Voice Control-Based Smart Assistive Devices in Consumer and Enterprise Verticals

5.2.2 Restraints

5.2.2.1 High Cost of High-End Voice Recognition System

5.2.2.2 Lack of Accuracy in Speech and Voice Recognition Systems in Noisy and Harsh Environments

5.2.2.3 Oligopoly in the Development of the Speech and Voice Recognition Technology Using Neural Networks Restricting Its Usage for Cloud-Based Services

5.2.3 Opportunities

5.2.3.1 Development of Speech and Voice Recognition Software for Micro-Linguistics and Local Languages

5.2.3.2 Application of Speech and Voice Recognition in Service Robotics

5.2.3.3 Use of Speech and Voice Recognition Technology in the Education of Temporarily and Permanently Disabled Students

5.2.3.4 Role of Speech and Voice Recognition Technology in Autonomous Cars

5.2.3.5 Growing Consumer Acceptance/Preferences for Technologically Advanced Products

5.2.4 Challenges

5.2.4.1 Possibility of Increased Errors With Change in Quality of Voice Samples Due to Fluctuations in the Physical Or Physiological State

5.2.4.2 Lack of Standardized Platform for the Development of Customized Speech and Voice Recognition Software Products

5.2.4.3 Low Internet Penetration and Slow Network Speed in Some Regions Pose A Challenge to Cloud-Based Sr Services

6 Delivery Methods in Speech and Voice Recognition (Page No. - 50)

6.1 Introduction

6.2 Artificial Intelligence (AI) Based

6.3 Non-Artificial Intelligence Based

7 Speech and Voice Recognition Market, By Technology (Page No. - 53)

7.1 Introduction

7.2 Voice Recognition

7.2.1 Increased Use of Biometrics Due to the Growing Threat of Cybersecurity and Data Breaches

7.3 Speech Recognition

7.3.1 Speech Recognition is Continuously Gaining Traction in Certain Healthcare Segments—Most Prominently Radiology

8 Speech and Voice Recognition Market, By Deployment Mode (Page No. - 60)

8.1 Introduction

8.2 on Cloud

8.2.1 On-Cloud is Expected to Account for the Largest Market By Far When Compared to On-Premises Solutions.

8.3 On-Premises/Embedded

8.3.1 On-Premise/Embedded Segment is Expected to Witness Higher Growth During the Forecast Period

9 Speech and Voice Recognition Market, By Vertical (Page No. - 63)

9.1 Introduction

9.2 Automotive

9.2.1 Role of Speech and Voice Recognition Technology in Autonomous Cars

9.3 Enterprise

9.3.1 Market for Enterprise Robotics Application Expected to Grow at the Highest CAGR During the Forecast Period.

9.4 Consumer

9.4.1 Growth in the Number of Voice Control-Based Smart Assistive Devices in Consumer Vertical

9.5 Banking, Financial Services, & Insurance (BFSI)

9.5.1 Growing Demand for Voice Authentication in Mobile Banking Applications

9.6 Government

9.6.1 Demand for Biometric Technologies has Increased the Demand for Speech and Voice Recognition System in the Government Sector

9.7 Retail

9.7.1 Speech and Voice Recognition Can Help Retailers Combat Collusive Fraud, Thereby Reducing Losses

9.8 Healthcare

9.8.1 Demand for High-Quality Care and Reduced Cost, as Well as Increased Regulatory Compliance, is Fuelling the Growth of the Market for the Healthcare Vertical

9.9 Military

9.9.1 Voice Recognition Systems Can Improve the Access Control Systems to Enhance the Safety of Weapons and Premises

9.10 Legal

9.10.1 High Demand for Speech Recognition Software in Law Offices Drives the Speech and Voice Recognition Market in the Legal Vertical

9.11 Education

9.11.1 Increasing Use of Speech and Voice Recognition Technology in the Education of Temporarily and Permanently Disabled Students

9.12 Others

10 Speech and Voice Recognition Market, By Geography (Page No. - 98)

10.1 Introduction

10.2 Americas

10.2.1 US

10.2.1.1 US Accounted for the Largest Size of Speech and Voice Recognition Market in Americas

10.2.2 Canada

10.2.2.1 Deployment of Voice Biometrics Technology in the Banking Industry to Enhance Security Levels

10.2.3 Rest of the Americas

10.2.3.1 High Growth Opportunities for Electronics and Automotive Verticals Expected to Drive Growth of Market in Rest of American Countries

10.3 Europe

10.3.1 UK

10.3.1.1 Significant Government Investments for Implementing Biometric Technologies to Ensure Network Security

10.3.2 Germany

10.3.2.1 Greater Dependence on AI and Cognitive Technologies in Enterprises

10.3.3 France

10.3.3.1 Plans to Integrate Voice Technology With Other Interfaces Across the Retail Vertical

10.3.4 Rest of Europe

10.3.4.1 Rising Demand for Improving Consumer Experience in the BFSI and Retail Industry Verticals

10.4 APAC

10.4.1 Japan

10.4.1.1 Deployment of Speech Recognition to Support Decoding in Real Time

10.4.2 China

10.4.2.1 Significant Investments in the Biometric Sector to Enhance the Security Applications

10.4.3 India

10.4.3.1 Large-Scale Residential Development and Increasing Mobile and Internet Penetration Expected to Drive Growth of Indian Market

10.4.4 Rest of APAC

10.5 RoW

10.5.1 Middle East

10.5.1.1 Rising Penetration of Voice Biometric System to Maintain High Levels of Security and Safety

10.5.2 Africa

10.5.2.1 Banks Collaborating With Software Provides Globally to Implement Voice Recognition in Banking Operations

11 Competitive Landscape (Page No. - 113)

11.1 Introduction

11.2 Market Ranking Analysis: Speech & Voice Recognition Market

11.3 Competitive Situations and Trends

11.3.1 Product Launches and Developments

11.3.2 Partnerships and Collaborations

11.3.3 Acquisitions

11.4 Competitive Leadership Mapping

11.4.1 Visionary Leaders

11.4.2 Dynamic Differentiators

11.4.3 Innovators

11.4.4 Emerging Companies

11.5 Strength of Product Portfolio

11.6 Business Strategy Excellence

12 Company Profiles (Page No. - 121)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

12.1 Key Players

12.1.1 Nuance Communication

12.1.2 Microsoft

12.1.3 Alphabet

12.1.4 IBM

12.1.5 Sensory

12.1.6 Cantab Research

12.1.7 Amazon

12.1.8 Baidu

12.1.9 Iflytek

12.1.10 Raytheon BBN Technologies

12.2 Other Companies

12.2.1 M2sys

12.2.2 Mmodal

12.2.3 Voicevault

12.2.4 Validsoft

12.2.5 Lumenvox

12.2.6 Acapela Group

12.2.7 Vocalzoom

12.2.8 Biotrust Id

12.2.9 Uniphore Software

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 153)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (74 Tables)

Table 1 Speech and Voice Recognition Market, By Technology, 2016–2024 (USD Billion)

Table 2 Voice Recognition Market, By Region, 2016–2024 (USD Million)

Table 3 Speech Recognition Market, By Region, 2016–2024 (USD Billion)

Table 4 Speech Recognition Market, By Type, 2016–2024 (USD Billion)

Table 5 Automatic Speech Recognition Market, By Region, 2016–2024 (USD Billion)

Table 6 Text to Speech Market, By Region, 2016–2024 (USD Million)

Table 7 Speech and Voice Recognition Market, By Deployment Mode, 2016–2024 (USD Billion)

Table 8 On Cloud Speech & Voice Recognition Market, By Region, 2016–2024 (USD Million)

Table 9 On-Premises/Embedded Speech and Voice Recognition Market, By Region, 2016–2024 (USD Million)

Table 10 Speech and Voice Recognition Market, By Vertical, 2016–2024 (USD Million)

Table 11 Voice Recognition Market, By Vertical, 2016–2024 (USD Million)

Table 12 Speech Recognition Market, By Vertical, 2016–2024 (USD Million)

Table 13 Speech and Voice Recognition Market in Automotive, By Application, 2016–2024 (USD Million)

Table 14 Speech Recognition Market in Automotive, By Application, 2016–2024 (USD Million)

Table 15 Speech Recognition Market in Automotive, By Region, 2016–2024 (USD Million)

Table 16 Voice Recognition Market in Automotive, By Application, 2016–2024 (USD Million)

Table 17 Voice Recognition Market in Automotive, By Region, 2016–2024 (USD Million)

Table 18 Speech and Voice Recognition Market in Enterprise, By Application, 2016–2024 (USD Million)

Table 19 Voice Recognition Market in Enterprise, By Region, 2016–2024 (USD Million)

Table 20 Speech Recognition Market in Enterprises, By Region (USD Million)

Table 21 Speech Recognition Market in Enterprise, By Application, 2016–2024 (USD Million)

Table 22 Voice Recognition Market in Enterprise, By Application, 2016–2024 (USD Million)

Table 23 Speech and Voice Recognition Market in Consumer, By Application, 2016–2024 (USD Million)

Table 24 Speech Recognition Market in Consumer, By Application, 2016–2024 (USD Million)

Table 25 Voice Recognition in Consumer Market, By Application, 2016–2024 (USD Million)

Table 26 Voice Recognition in Consumer, By Region, 2016–2024 (USD Million)

Table 27 Speech Recognition Market in Consumer, By Region, 2016–2024 (USD Million)

Table 28 Voice Recognition Market in Banking, Financial Services, & Insurance, By Region, 2016–2024 (USD Million)

Table 29 Speech Recognition Market in Banking, Financial Services, & Insurance, By Region, 2016–2024 (USD Million)

Table 30 Speech Recognition Market in Banking, Financial Services, & Insurance, By Application, 2016–2024 (USD Million)

Table 31 Voice Recognition Market in Banking, Financial Services, & Insurance, By Application, 2016–2024 (USD Million)

Table 32 Speech & Voice Recognition Market in Banking, Financial Services, & Insurance, By Application, 2016–2024 (USD Million)

Table 33 Speech Recognition Market in Government, By Region, 2016–2024 (USD Million)

Table 34 Voice Recognition Market in Government, By Region, 2016–2024 (USD Million)

Table 35 Voice Recognition Market in Government, By Application, 2016–2024 (USD Million)

Table 36 Speech & Voice Recognition Market in Government, By Application, 2016–2024 (USD Million)

Table 37 Speech Recognition Market in Government, By Application (USD Million)

Table 38 Speech Recognition Market in Retail, By Region, 2016–2024 (USD Million)

Table 39 Voice Recognition Market in Retail, By Region, 2016–2024 (USD Million)

Table 40 Speech Recognition Market in Retail, By Application, 2016–2024 (USD Million)

Table 41 Voice Recognition Market in Retail, By Application, 2016–2024 (USD Million)

Table 42 Speech and Voice Recognition Market in Retail, By Application, 2016–2024 (USD Million)

Table 43 Voice Recognition Market in Healthcare, By Region, 2016–2024 (USD Million)

Table 44 Speech Recognition Market in Healthcare, By Region, 2016–2024 (USD Million)

Table 45 Speech Recognition Market in Healthcare, By Application, 2016–2024 (USD Million)

Table 46 Voice Recognition Market in Healthcare, By Application, 2016–2024 (USD Million)

Table 47 Speech & Voice Recognition Market in Healthcare, By Application, 2016–2024 (USD Million)

Table 48 Speech & Voice Recognition Market in Military, By Application, 2016–2024 (USD Million)

Table 49 Voice Recognition Market in Military, By Application, 2016–2024 (USD Million)

Table 50 Speech Recognition Market in Military, By Application, 2016–2024 (USD Million)

Table 51 Speech Recognition Market in Military, By Region, 2016–2024 (USD Million)

Table 52 Voice Recognition Market in Military, By Region, 2016–2024 (USD Million)

Table 53 Speech & Voice Recognition Market in Legal, By Application, 2016–2024 (USD Million)

Table 54 Voice Recognition Market in Legal Vertical, By Application, 2016–2024 (USD Million)

Table 55 Speech Recognition Market in Legal, By Application, 2016–2024 (USD Million)

Table 56 Speech Recognition Market in Legal, By Region, 2016–2024 (USD Million)

Table 57 Voice Recognition Market in Legal, By Region, 2016–2024 (USD Million)

Table 58 Voice Recognition Market in Education, By Region, 2016–2024 (USD Million)

Table 59 Speech Recognition Market in Education, By Region, 2016–2024 (USD Million)

Table 60 Speech Recognition Market in Education, By Application, 2016–2024 (USD Million)

Table 61 Voice Recognition Market in Education, By Application, 2016–2024 (USD Million)

Table 62 Speech & Voice Recognition Market in Education, By Application, 2016–2024 (USD Million)

Table 63 Voice Recognition Market in Others, By Region, 2016–2024 (USD Million)

Table 64 Speech Recognition Market in Others, By Region, 2016–2024 (USD Million)

Table 65 Speech and Voice Recognition Market, By Region, 2016–2024 (USD Billion)

Table 66 Speech Recognition Market, By Region, 2016–2024 (USD Billion)

Table 67 Voice Recognition Market, By Region, 2016–2024 (USD Million)

Table 68 Speech and Voice Recognition Market in Americas, By Country, 2016–2024 (USD Million)

Table 69 Speech and Voice Recognition Market in Europe, By Country, 2016–2024 (USD Million)

Table 70 Speech and Voice Recognition Market in APAC, By Country, 2016–2024 (USD Million)

Table 71 Speech and Voice Recognition Market in RoW, By Region, 2016–2024 (USD Million)

Table 72 Product Launches and Developments (2016–2018)

Table 73 Partnerships and Collaborations (2015–2018)

Table 74 Acquisitions, 2016–2018

List of Figures (47 Figures)

Figure 1 Speech and Voice Recognition Market: Research Design

Figure 2 Process Flow of Market Size Estimation

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Speech and Voice Recognition Market Between 2016 and 2024 (USD Million)

Figure 7 Voice Recognition Market Expected to Grow at A Higher CAGR Between 2018 and 2024

Figure 8 Consumer Vertical Expected to Hold the Largest Market Size During the Forecast Period

Figure 9 On-Premise/Embedded Deployment Mode Expected to Witness Higher Growth Between 2018 and 2024

Figure 10 Speech and Voice Recognition Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 11 Speech and Voice Recognition Market in APAC to Grow at Highest CAGR From 2018 to 2024

Figure 12 Market for Speech Recognition Holds the Major Market Share During Forecast Period

Figure 13 Automatic Speech Recognition to Hold Largest Size of Speech Recognition Market During Forecast Period

Figure 14 China Accounted for Largest Share of Speech and Voice Recognition Market in APAC in 2018

Figure 15 US Held the Largest Share of Speech and Voice Recognition Market in 2018

Figure 16 Increasing Use of Speech and Voice Recognition in Consumer Electronics Devices

Figure 17 Identity Theft Accounted for More Than Half of the Total Data Breaches in 2017

Figure 18 Use of Speech Recognition Can Effectively Prevent Identity Theft in Banking and Finance

Figure 19 Speech and Voice Recognition Technology Witnessed Considerable Growth in Accuracy During 2010–2017

Figure 20 Growth of Amazon’s Alexa Skill Set Till March 2018

Figure 21 Installation of Connected Devices in Smart Homes Within Smart Cities

Figure 22 Delivery Methods in Speech & Voice Recognition

Figure 23 Speech Recognition to Hold the Major Market Share Between 2018 and 2024

Figure 24 Automatic Speech Recognition Market, By Region, 2018–2024 (USD Billion)

Figure 25 On Cloud to Hold Major Market Share Between 2018 and 2024

Figure 26 Consumer Vertical to Hold the Largest Share of Speech Recognition Market Throughout the Forecast Period

Figure 27 Voice Recognition Market in Automotive, By Application, 2018–2024 (USD Million)

Figure 28 Consumer Speech and Voice Recognition for Wearable Device Control Application to Grow at Higher CAGR During Forecast Period

Figure 29 APAC to Hold Largest Size of the Speech Recognition Market for the Consumer Vertical During the Forecast Period

Figure 30 Voice Recognition Market in Government, By Application, 2018–2024 (USD Million)

Figure 31 Americas to Hold the Largest Size of Speech Recognition Market for the Healthcare Vertical During the Forecast Period

Figure 32 Voice Recognition Market in Legal, By Region, 2018–2024 (USD Million)

Figure 33 Voice Recognition Market for Education, By Application, 2018–2024 (USD Million)

Figure 34 APAC to Hold Largest Size of the Voice Recognition Market for the Others Vertical During the Forecast Period

Figure 35 Geographic Snapshot: Speech and Voice Recognition Market in APAC Expected to Grow at the Highest CAGR During the Forecast Period

Figure 36 Americas: Speech and Voice Recognition Market Snapshot

Figure 37 Europe: Speech and Voice Recognition Market Snapshot

Figure 38 APAC: Speech and Voice Recognition Market Snapshot

Figure 39 Key Growth Strategies Adopted By Top Companies, 2015–2018

Figure 40 Market Ranking of the Top 5 Players in the Speech & Voice Recognition Market, 2017

Figure 41 Speech and Voice Recognition Market (Global) Competitive Leadership Mapping, 2017

Figure 42 Nuance Communication: Company Snapshot

Figure 43 Microsoft: Company Snapshot

Figure 44 Alphabet: Company Snapshot

Figure 45 IBM: Company Snapshot

Figure 46 Amazon: Company Snapshot

Figure 47 Baidu: Company Snapshot