Display Market by Product (Smartphone, Wearables, Television, Automotive, Signage), Technology (LCD, OLED (Flexible, Foldable, Rigid), Direct-View LED, Micro-LED), Panel Size (Micro, Small & Medium, Large), Industry, and Geography - Global Forecast to 2024

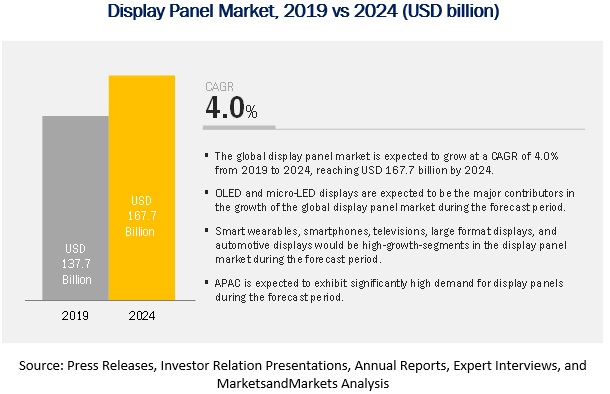

Factors like increasing deployment of HUD, central stack display, and instrument cluster in automotive vehicles; and rising focus toward technological shift and development of energy-efficient, attractive, and high-end-specification display products are also contributing significantly toward the display panel market’s growth.

Increasing demand for display panels with high resolution, fast response time, and better picture quality is expected to direct the display panel market toward major innovations, and subsequently significant growth. High growth opportunities can be identified in emerging use cases including smart displays, smart mirrors, smart home appliances; emerging display technologies such as micro-LED and true quantum dot; and smart wearable display segments that include AR/VR HMDs and smartwatches. Smartphone, television, and automotive segments are also expected to offer high growth opportunities.

“Smartphones to dominate display panel market (in terms of share) during forecast period”

Smartphones have been dominating the display panel market, with Apple and Samsung dominating the whole smartphone segment. The growth of the display panel market for smartphones will be propelled mainly by OLED and flexible displays during the forecast period. At present, flexible OLED technology-based (highly priced) display panels are being adopted in smartphones at a high rate globally; this trend is expected to continue during the forecast period. The major factors boosting the use of OLED displays in smartphones include energy-efficiency, sunlight readability, vivid color and picture quality, and easier recyclability than LCDs.

“Micro-LED technology to witness highest CAGR during forecast period”

The market for micro-LED displays is expected to grow at the highest CAGR during the forecast period. Micro-LED is an emerging display technology and has the potential to disrupt the LCD and OLED display ecosystem. Increasing demand for brighter and more power-efficient display panels for smartwatches, mobile devices, and NTE (AR/VR) devices will be the major factors for the growth of micro-LED technology in the display panel market. Considering current manufacturing capabilities, prototype development, and the involvement of leading players Apple, Samsung, and Sony , micro-LED-based smartwatches and NTE devices may enter the commercial phase in 2019.

“Small-and medium-sized display panels expected to gain share in global market during forecast period”

At present, large-sized display panels are in demand for televisions, PC monitors and laptops, signage and some tablets; therefore, the large-sized display panels account for the largest market share. However, small- and medium-sized display panels are expected to gain share in the global market during the forecast period. The growth in this segment will mainly be driven by high growth of OLED display panels, especially for smartphones.

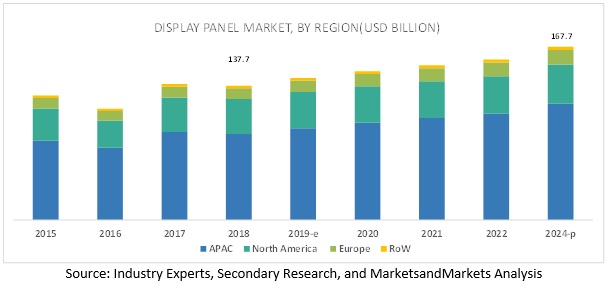

“APAC to account for highest demand in display panel market during forecast period”

APAC is the leading region in terms of production and consumption of display panels. The region has witnessed significant advancements in the display device market, along with rapid changes in terms of adoption of new technologies. The huge market size in APAC is because of the rapid industrialization, as well as the presence of a large number of OEMs and many consumers in the region. Major companies such as Samsung Electronics and LG Electronics being based in South Korea, and Sony, Sharp, Panasonic, and a few others being based in Japan, contribute significantly to the display panel market’s growth in this region.

Key Market Players

Samsung Electronics Co. Ltd (South Korea); LG Display Co. Ltd. (South Korea); BOE Technology Group Co. Ltd (China); AU Optronics Corp. (Taiwan); Innolux Corp. (Taiwan); Japan Display Inc. (Japan); Sharp Corp. (Sharp, Foxconn) (Japan); China Star Optoelectronics Technology (CSOT, CDOT, TCL) (China); Tianma Microelectronics Co. Ltd. (China); and Truly International Holdings Ltd. (Hong Kong) are the leading players in the display panel market.

Scope of the Report:

|

Report Metric |

Details |

|

Base year |

2018 |

|

Forecast period |

2019–2024 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Samsung Electronics Co. Ltd (South Korea); LG Display Co. Ltd. (South Korea); BOE Technology Group Co. Ltd (China); AU Optronics Corp. (Taiwan); Innolux Corp. (Taiwan); Japan Display Inc. (Japan); Sharp Corp. (Sharp, Foxconn) (Japan); China Star Optoelectronics Technology (CSOT, CDOT, TCL) (China). |

BOE is one of the very few companies that have witnessed rapid growth in the display panel market. Its display business revenue grew by ~33% in 2017 (compared to 2016), whereas its R&D investment increased by 66% during that period. The company is focused on market expansion and strategic client cooperation in new application areas such as automobile, retail, industrial, healthcare, and education.

Samsung Display is the leading producer of small- and medium-sized AMOLED displays for smartphones and other devices. In 2017, the company generated approximately USD 30.5 billion in revenue from its display business, 69% of which came from OLED display panels. Samsung has utilized its AMOLED displays in its flagship smartphones, such as the Galaxy lineup, and the company has witnessed high growth in 2017 with Apple’s adoption of AMOLED displays in its smartphones.

Key developments

- In August 2018, AU Optronics launched the 85-inch 8K4K bezel-less ALCD TV display, which combines bezel-less, next-generation HDR, 120Hz ultra-high refresh rate, and quantum dot wide color gamut technologies to deliver exceptional image quality and appearance.

- In August 2018, Innolux showcased the world’s first OLED watch (1.39-inch 400*400 P-OLED flexible smartwatch with LTPS process).

- In August 2018, Tianma announced the commencement of its G6 OLED production line’s operations at Wuhan, China. The production line uses LTPS substrate and has complete core process capability, such as OLED evaporation and packaging. It supports the production of rigid as well as flexible OLEDs.

- In June 2018, Samsung Electronics introduced “The Wall Professional” at the InfoComm 2018. It is a large-format indoor micro-LED display which can be extended to hundreds of inches and offers brilliant presentation quality.

Key questions addressed by the report:

- What are the opportunities for display panel manufacturers?

- How much growth is expected from LCD, OLED, and micro-LED displays in the market and what would be the impact of these display technologies on different products?

- Who are the major current and potential competitors in the market, and what are their top priorities, strategies, and developments?

- What can be the potential impact of commercialization of micro-LED and True QD displays?

1 Introduction (Page No. - 21)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 25)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 43)

4.1 Attractive Opportunities in Display Panel Market

4.2 Global Display Panel Market, in Terms of Value, By Product

4.3 LCD Display Panel Market, in Terms of Volume and Value, By Product

4.4 OLED Display Panel Market Share, in Terms of Value, By Product

4.5 Micro-LED Display Panel Market Share, in Terms of Volume and Value, By Product

4.6 Smartphone Display Panel Market Share, in Terms of Value, By Display Technology

4.7 Smart Wearable Display Panel Market Share, in Terms of Value, By Display Technology

4.8 Display Panel Market in APAC, By Country and Product

5 Market Overview (Page No. - 49)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Adoption of OLED Displays in Smartphones and High Demand for Flexible Display Panels

5.2.1.2 Huge Investments Toward, Along With Government Support For, Construction of New OLED and LCD Panel Manufacturing Facilities

5.2.1.3 Increasing Demand for 4K & 8K Displays With the Availability of Uhd Content

5.2.1.4 Growth in Automotive Displays—HUD, Central Stack Display, and Instrument Cluster

5.2.1.5 Technological Shift and Development of Energy-Efficient, Attractive, and High-End-Specification Display Product

5.2.2 Restraints

5.2.2.1 Saturated Growth and Declining Shipment of Display Panels for TVS, Tablets, and Monitors

5.2.2.2 Deployment of Widescreen Alternatives, Such as Projectors and Screenless Displays

5.2.3 Opportunities

5.2.3.1 Emerging Use Cases—Smart Display, Smart Mirror, Smart Home Appliances

5.2.3.2 Emerging Display Technologies—Micro-LED and True Quantum Dot

5.2.3.3 Growth in Smart Wearable Display Market—AR/VR HMDS and Smartwatches

5.2.3.4 Growing Number of Vendors Adopting OLED Display Panels for Televisions

5.2.4 Challenges

5.2.4.1 Fluctuating Average Selling Price of Display Panels

5.2.4.2 Complex Supply Chain and Manufacturing Processes

5.2.4.3 High Costs Associated With New Display Technology-Based Products

6 Industry Trends (Page No. - 65)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 R&D

6.2.2 Manufacturing

6.2.3 Assembly and Integration

6.2.4 Input Suppliers

6.3 Emerging Display Technologies

6.3.1 Technology Comparison: LCD vs OLED vs Micro-LED

6.3.2 Commercialization Potential and Impact of Micro-LED

6.3.3 Quantum Dot

6.3.3.1 Quantum Dot Enhancement Film (QCEF)

6.3.3.2 Quantum Dot Color Filter (QDCF)

6.3.3.3 True Quantum Dot

6.3.4 Display Backplane—A-Si, LTPS, Igzo

6.4 Key Trends

6.4.1 Flexible and Foldable Displays

6.4.2 Microdisplay

6.5 Emerging Use-Cases

6.5.1 Smart Mirror

6.5.2 Smart Home Display (Voice-Controlled Display)

6.5.2.1 Voice-Controlled/Assistant Smart Display

6.5.2.2 Smart Home Appliance Display

7 Display Panel Market, By Product (Page No. - 73)

7.1 Introduction

7.2 Smartphone

7.2.1 OLED Displays to Dominate Smartphone Segment During Forecast Period

7.3 Television

7.3.1 LCD Displays to Continue Occupying Major Share of Television Segment During Forecast Period

7.4 PC Monitor & Laptop

7.4.1 PC Monitor & Laptop Segment to Witness Declined Growth During Forecast Period

7.5 Large Format/Professional Display (Digital Signage)

7.5.1 Direct-View LED Displays to Dominate Large Format Display Segment During Forecast Period

7.6 Automotive Display

7.6.1 Head-Up Display (HUD)

7.6.1.1 Newer Technologies—Oled and Micro-LED—To Witness Higher Growth in HUD Segment During Forecast Period

7.6.2 Central Stack Display

7.6.2.1 LCD Technology to Occupy Major Share of Central Stack Display Segment During Forecast Period

7.6.3 Instrument Cluster

7.6.3.1 Digital Instrument Clusters Rapidly Replacing Analog Ones in Premium Automotive Segment

7.7 Tablet

7.7.1 Display Panel Demand for Tablets Expected to Decline During Forecast Period

7.8 Smart Wearables

7.8.1 Smartwatch

7.8.1.1 OLED Displays to Continue Dominating Smartwatch Segment During Forecast Period

7.8.2 AR HMD

7.8.2.1 Micro-LED to Emerge as Disruptive Display Technology in AR-HMD Segment During Forecast Period

7.8.3 VR HMD

7.8.3.1 Direct-View Display-Based VR HMDS

7.8.3.2 Microdisplay-Based VR HMDS

7.9 Others

7.9.1 Emerging Use-Cases Like Smart Home Displays and Smart Mirrors to Drive Market in Other Product Segment During Forecast Period

8 Display Panel Market, By Display Technology (Page No. - 105)

8.1 Introduction

8.2 LCD

8.2.1 LED-LCD

8.2.1.1 Smart Wearables Segment to Witness Highest CAGR in LCD Display Panel Market During Forecast Period

8.2.2 QD-LCD (QDEF-LCD)

8.2.2.1 Television Segment is Defining the QD-LCD Market Segment

8.3 OLED

8.3.1 Flexible & Foldable

8.3.1.1 Smartphones and Smart Wearables to Define Growth of Flexible OLED Display Market

8.3.2 Rigid

8.3.2.1 Major Adoption of Rigid Panels Expected in Television, Automotive, and Monitor Devices During Forecast Period

8.4 Micro-LED

8.4.1 Micro-LED Display Panel Shipment to Surge Rapidly 2020 Onwards

8.5 Direct-View LED

8.5.1 Direct-View Fine-Pixel LED

8.5.1.1 With Falling Prices, Fine-Pixel LED Displays to Witness Rapid Growth During Forecast Period

8.5.2 Direct-View Large-Pixel LED

8.5.2.1 Large-Pixel LED Displays Expected to Find Major Applications in Outdoor Environment

8.6 Others

8.6.1 APAC to Dominate Display Panel Market for Other Technologies, in Terms of Size, During Forecast Period

9 Display Panel Market, By Panel Size (Page No. - 131)

9.1 Introduction

9.2 Microdisplays

9.2.1 Micro-LED Displays to Define Microdisplay Market During Forecast Period

9.3 Small- & Medium-Sized Panels

9.3.1 OLED to Emerge as Leading Display Technology in Small- and Medium-Sized Segment By 2024

9.4 Large-Sized Panels

9.4.1 LCD Displays Expected to Continue Dominating Large-Sized Display Panel Segment During Forecast Period

10 Display Panel Market, By Industry (Page No. - 139)

10.1 Introduction

10.2 Consumer

10.2.1 Comsumer Segment to Dominate Market During Forecast Period

10.3 Automotive

10.3.1 Display Panel Market to Witness High Growth in Automotive Industry During Forecast Period

10.4 Sports & Entertainment

10.4.1 Rapid Penetration of AR/VR HMDS Into Sports and Entertainment Industry Would Be Major Growth Driver During Forecast Period

10.5 Transportation

10.5.1 Large Format Displays to Lead Display Panel Market in Transportation Industry

10.6 Retail, Hospitality, and BFSI

10.6.1 Digital Signage to Lead Display Panel Market in Retail, Hospitality, and BFSI Industries

10.7 Industrial & Enterprise

10.7.1 Increasing Adoption of AR/VR-HMDS to Drive Market’s Growth in Industrial and Enterprise Industries

10.8 Education

10.8.1 High Demand for Devices—Lfds and AR/VR HMDS—To Drive Market in Education Industry

10.9 Healthcare

10.9.1 Display Panel Demand for Medical Devices and Equipment to Surge During Forecast Period

10.10 Military, Defense, and Aerospace

10.10.1 HUD, AR & VR HMDS, and Rugged Display Devices to Drive Market’s Growth in Military, Defense, and Aerospace Industries

10.11 Others

10.11.1 HMD to Lead Display Panel Market in Other Industry

11 Geographic Analysis (Page No. - 147)

11.1 Introduction

11.2 APAC

11.2.1 South Korea

11.2.1.1 South Korea to Account for Major OLED Display Panel Demand During Forecast Period

11.2.2 China

11.2.2.1 China to Command Display Panel Market in APAC During Forecast Period

11.2.3 Japan

11.2.3.1 High Demand of Display Panels in Automotive and HMD Expected in Japan During Forecast Period

11.2.4 Taiwan

11.2.4.1 Display Panel Production in Taiwan to Surge During Forecast Period

11.2.5 Rest of APAC

11.2.5.1 Display Panel Demand Expected to Increase Rapidly in India, Hong Kong, Singapore, Malaysia, and Thailand During Forecast Period

11.3 North America

11.3.1 US

11.3.1.1 US Market to Witness High Panel Demand in Smartphone, Television, and Automotive Segments During Forecast Period

11.3.2 Canada and Mexico

11.3.2.1 Consumer, Automotive, Retail, Medical, and Industrial Sectors to Be Major Users of Display-Based Devices in Canada and Mexico

11.4 Europe

11.4.1 Germany

11.4.1.1 Germany to Lead Display Panel Market in Europe During Forecast Period

11.4.2 France

11.4.2.1 French Display Panel Market to Witness Growth in Signage, AR/VR, and HUD Segments

11.4.3 UK

11.4.3.1 UK to Witness Increased Demand for Display Panels During Forecast Period

11.4.4 Rest of Europe

11.4.4.1 Market in Rest of Europe Expected to Grow on Back of Consumer, Automotive, and Sports and Entertainment Industries

11.5 Rest of the World (RoW)

11.5.1 High Growth Opportunities Expected in RoW in Signage Applications During Forecast Period

12 Competitive Landscape (Page No. - 171)

12.1 Overview

12.2 Player Share Analysis: Display Panel Market

12.3 Competitive Leadership Mapping

12.3.1 Visionary Leaders

12.3.2 Dynamic Differentiators

12.3.3 Innovators

12.3.4 Emerging Companies

12.4 Competitive Benchmarking: Display Panel Market

12.4.1 Strength of Product Portfolio (25 Companies)

12.4.2 Business Strategy Excellence (25 Companies)

12.5 Competitive Situations and Trends

12.5.1 Product Launches and Developments

12.5.2 Expansion

12.5.3 Agreements, Partnerships, Collaborations, & Joint Ventures

12.5.4 Mergers & Acquisitions

13 Company Profiles (Page No. - 184)

13.1 Introduction

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.2 Key Players

13.2.1 Samsung Electronics

13.2.2 LG Display

13.2.3 BOE Technology

13.2.4 AU Optronics (AUO)

13.2.5 Innolux Corporation

13.2.6 Japan Display (JDI)

13.2.7 Sharp (Foxconn)

13.2.8 China Star Optoelectronics Technology (CSOT) (CDOT) (TCL)

13.2.9 Tianma Microelectronics

13.2.10 Truly International

13.3 Other Players

13.3.1 Chunghwa Picture Tubes (CPT) (Tatung)

13.3.2 Hannstar Display

13.3.3 CEC Panda

13.3.4 BOE Varitronix

13.4 Key Innovators

13.4.1 Apple (Luxvue)

13.4.2 Sony

13.4.3 E Ink Holdings

13.4.4 Universal Display Corp. (UDC)

13.4.5 Joled

13.4.6 Emagin Corporation

13.4.7 Kopin Corporation

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 222)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customization

14.4 Related Reports

14.5 Author Details

List of Tables (69 Tables)

Table 1 LCD and OLED Fab Construction Roadmap in China

Table 2 Display Technology Comparison

Table 3 Microdisplay Technology Comparison

Table 4 Leading Players and Respective Voice-Controlled Smart Display Devices, 2018

Table 5 Display Panel Market, By Product, 2015–2024 (Million Units)

Table 6 Display Panel Market, By Product, 2015–2024 (USD Billion)

Table 7 Smartphone Display Panel Market, By Display Technology, 2015–2024 (USD Billion)

Table 8 Smartphone Display Panel Market, By Geography, 2015–2024 (USD Billion)

Table 9 Television Display Panel Market, By Display Technology, 2015–2024 (USD Billion)

Table 10 Television Display Panel Market, By Geography, 2015–2024 (USD Billion)

Table 11 PC Monitor & Laptop Display Panel Market, By Display Technology, 2015–2024 (USD Billion)

Table 12 PC Monitor & Laptop Display Panel Market, By Geography, 2015–2024 (USD Billion)

Table 13 Large Format Display Panel Market, By Display Technology, 2015–2024 (USD Billion)

Table 14 Large Format Display Panel Market, By Geography, 2015–2024 (USD Billion)

Table 15 Automotive Display Panel Market, By Display Technology, 2015–2024 (USD Billion)

Table 16 Automotive Display Panel Market, By Geography, 2015–2024 (USD Billion)

Table 17 Automotive Display Panel Market, By Display Type, 2015–2024 (USD Billion)

Table 18 Automotive HUD Panel Market, By Display Technology, 2015–2024 (USD Million)

Table 19 Automotive Central Stack Display Panel Market, By Display Technology, 2015–2024 (USD Billion)

Table 20 Automotive Instrument Cluster Display Panel Market, By Display Technology, 2015–2024 (USD Billion)

Table 21 Tablet Display Panel Market, By Display Technology, 2015–2024 (USD Billion)

Table 22 Tablet Display Panel Market, By Geography, 2015–2024 (USD Billion)

Table 23 Smart Wearable Display Panel Market, By Display Technology, 2015–2024 (USD Million)

Table 24 Smart Werables Display Panel Market, By Geography, 2015–2024 (USD Million)

Table 25 Smart Wearables Display Panel Market, By Wearable Type, 2015–2024 (USD Million)

Table 26 Smartwatch Display Panel Market, By Display Technology, 2015–2024 (USD Million)

Table 27 AR HMD Display Panel Market, By Display Technology, 2015–2024 (USD Million)

Table 28 VR HMD Display Panel Market, By Display Type, 2015 –2024 (USD Million)

Table 29 Direct-View Display Panel Market for VR HMD, By Display Technology, 2015–2024 (USD Million)

Table 30 Microdisplay Panel Market for VR HMD, By Display Technology, 2015–2024 (USD Million)

Table 31 Display Panel Market for Other Products, By Display Technology, 2015–2024 (USD Billion)

Table 32 Display Panel Market for Other Products, By Geography, 2015–2024 (USD Billion)

Table 33 Display Panel Market, By Display Technology, 2015–2024 (USD Billion)

Table 34 LCD Display Panel Market, By Product, 2015–2024 (Million Units)

Table 35 LCD Display Panel Market, By Product, 2015–2024 (USD Billion)

Table 36 LCD Display Panel Market, By Smart Wearables, 2015–2024 (USD Million)

Table 37 LCD Display Panel Market, By Panel Size, 2015–2024 (USD Billion)

Table 38 LCD Display Panel Market, By Geography, 2015–2024 (USD Billion)

Table 39 OLED Display Panel Market, By Product, 2015–2024 (Million Units)

Table 40 OLED Display Panel Market, By Product, 2015–2024 (USD Billion)

Table 41 OLED Display Panel Market, By Smart Wearables, 2015–2024 (USD Million)

Table 42 OLED Display Panel Market, By Panel Size, 2015–2024 (USD Billion)

Table 43 OLED Display Panel Market, By Geography, 2015–2024 (USD Billion)

Table 44 OLED Display Panel Market, By Panel Type, 2015–2024 (USD Billion)

Table 45 Micro-LED Display Panel Market, By Product, 2015–2024 (Million Units)

Table 46 Micro-LED Display Panel Market, By Product, 2015–2024 (USD Billion)

Table 47 Micro-LED Display Panel Market, By Smart Wearables, 2015–2024 (USD Million)

Table 48 Micro-LED Display Panel Market, By Panel Size, 2015–2024 (USD Billion)

Table 49 Micro-LED Display Panel Market, By Geography, 2015–2024 (USD Billion)

Table 50 Direct-View LED Display Panel Market, By Geography, 2015–2024 (USD Billion)

Table 51 Display Panel Market for Other Technologies, By Geography, 2015–2024 (USD Billion)

Table 52 Display Panel Market, By Panel Size, 2015–2024 (USD Billion)

Table 53 Microdisplay Market, By Display Technology, 2015–2024 (USD Million)

Table 54 Small- & Medium-Sized Display Panel Market, By Display Technology, 2015–2024 (USD Billion)

Table 55 Large-Sized Display Panel Market, By Display Technology, 2015–2024 (USD Billion)

Table 56 Display Panel Market, By Industry, 2015–2024 (USD Billion)

Table 57 Display Panel Market, By Region, 2015–2024 (USD Billion)

Table 58 Display Panel Market in APAC, By Display Technology, 2015–2024 (USD Billion)

Table 59 Display Panel Market in APAC, By Product, 2015–2024 (USD Billion)

Table 60 Display Panel Market in APAC, By Country, 2015–2024 (USD Billion)

Table 61 Display Panel Market in North America, By Display Technology, 2015–2024 (USD Billion)

Table 62 Display Panel Market in North America, By Product, 2015–2024 (USD Billion)

Table 63 Display Panel Market in North America, By Country, 2015–2024 (USD Billion)

Table 64 Display Panel Market in Europe, By Display Technology, 2015–2024 (USD Billion)

Table 65 Display Panel Market in Europe, By Product, 2015–2024 (USD Billion)

Table 66 Display Panel Market in Europe, By Country, 2015–2024 (USD Billion)

Table 67 Display Panel Market in RoW, By Display Technology, 2015–2024 (USD Million)

Table 68 Display Panel Market in RoW, By Product, 2015–2024 (USD Million)

Table 69 Competitive Leadership Mapping: Evaluation Parameters and Respective Weightage

List of Figures (98 Figures)

Figure 1 Market Segmentation

Figure 2 Display Panel Market: Process Flow of Market Size Estimation

Figure 3 Display Panel Market: Research Design

Figure 4 Bottom-Up Approach to Arrive at Market Size

Figure 5 Top-Down Approach to Arrive at Market Size

Figure 6 Data Triangulation

Figure 7 Assumptions of Research Study

Figure 8 Global Display Panel Market, 2015–2024 (USD Billion)

Figure 9 LCD Displays to Account for Largest Size of Display Panel Market During Forecast Period

Figure 10 Smartphone Segment to Dominate Global Display Panel Market, in Terms of Size, During Forecast Period

Figure 11 Television Segment to Dominate LCD Display Panel Market, in Terms of Size, During Forecast Period

Figure 12 OLED Display Panels to Witness High Demand From Smartphone Segment During Forecast Period

Figure 13 Demand for Micro-LED Display Panels Expected to Surge 2020 Onwards

Figure 14 Microdisplay Panels Expected to Witness Highest CAGR During Forecast Period

Figure 15 APAC to Dominate Display Panel Market During Forecast Period

Figure 16 China to Witness Highest CAGR in Display Panel Market During Forecast Period

Figure 17 OLED and Micro-LED Displays to Define Display Panel Market Growth During Forecast Period

Figure 18 OLED and Micro-LED Displays to Gain Significant Share of Global Display Panel Market By 2024

Figure 19 Global Display Panel Market Outlook

Figure 20 Smart Wearables, Lfd, Smartphone, and Automotive Display Segments to Provide High-Growth Opportunities During Forecast Period

Figure 21 Demand for LCD Display Panels Likely to Decline During Forecast Period

Figure 22 LCD Display Market Size, in Terms of Value, to Decrease During Forecast Period

Figure 23 Smartphone Segment to Continue to Account for Largest Share of OLED Display Panel Market During Forecast Period

Figure 24 Micro-LED Display Panels to Be Largely Shipped for Smartphones and Smart Wearables By 2024

Figure 25 Smartphone Segment to Account for Largest Share of Micro-LED Display Panel Market, in Terms of Value, By 2024

Figure 26 OLED Displays to Capture Major Share of Smartphone Display Panel Market By 2024

Figure 27 OLED Displays to Hold Significantly Large Share of Smart Wearable Display Panel Market During Forecast Period

Figure 28 Smartphone Among Products and South Korea Among Countries Held Major Share of Display Panel Market in APAC in 2018

Figure 29 Drivers, Restraints, Opportunities, and Challenges for Display Panel Market

Figure 30 OLED Panel Shipment for Smartphones and Televisions, 2015–2024

Figure 31 OLED Display Panel Market, Flexible vs Rigid vs Foldable, 2015–2024 (USD Billion)

Figure 32 Shipment of 4K TV Forecasted to Grow Rapidly in Next 2 Years

Figure 33 Shipment of 8K TV Expected to Surge 2018 Onwards

Figure 34 ADAS Share in Global Sales of Light Vehicles, By Automation Level, 2017–2050

Figure 35 Automotive Display System Market to Double in Next 4 Years

Figure 36 Saturated Growth and Declining Shipment of Display Devices

Figure 37 Micro-LED Display Panel Market, 2017-2025 (USD Billion)

Figure 38 Micro-LED Ecosystem: Revenue Impact on Key Players in Supply Chain

Figure 39 Smart Wearable Display Panel Market, By Display Technology, 2017 vs 2019 vs 2024 (USD Billion)

Figure 40 Smart Wearable Display Panel Market, By Product Type, 2017 vs 2019 vs 2024 (USD Billion)

Figure 41 Display Panel Market: Value Chain Analysis

Figure 42 Display Panel Market Segmentation, By Product

Figure 43 Smartphone Segment to Dominate Global Display Panel Market, in Terms of Size, During Forecast Period

Figure 44 OLED Displays to Dominate Smartphone Segment, in Terms of Size, During Forecast Period

Figure 45 APAC to Dominate Smartphone Segment During Forecast Period

Figure 46 LCD Displays to Dominate Television Segment, in Terms of Size, During Forecast Period

Figure 47 North America to Witness Highest Growth in Display Panel Market for Television Segment During Forecast Period

Figure 48 PC Monitor & Laptop Display Panel Market to Witness Declined Growth Across All Regions During Forecast Period

Figure 49 Direct-View LED Displays to Dominate Large Format Display Segment, in Terms of Size, During Forecast Period

Figure 50 APAC to Dominate Display Panel Market for Large Format Display Segment During Forecast Period

Figure 51 LCD Displays to Dominate Automotive Segment, in Terms of Size, During Forecast Period

Figure 52 APAC to Dominate Display Panel Market for Automotive Segment During Forecast Period

Figure 53 Automotive Display Panel Market to Witness Highest Growth in HUD Segment During Forecast Period

Figure 54 OLED Displays to Dominate Smart Wearables Segment, in Terms of Size, During Forecast Period

Figure 55 Smart Wearables Display Panel Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 56 AR HMD Subsegment to Grow at Highest CAGR in Smart Wearables Display Panel Market During Forecast Period

Figure 57 Micro-LED Displays to Dominate AR HMD Segment During Forecast Period

Figure 58 Display Panel Market Segmentation, By Display Technology

Figure 59 LCD Displays to Dominate Global Display Panel Market, in Terms of Size, During Forecast Period

Figure 60 Smartphones to Be Dominating Product Segment, in Terms of Shipment, in LCD Display Panel Market During Forecast Period

Figure 61 Television Segment to Dominate LCD Display Panel Market, in Terms of Size, During Forecast Period

Figure 62 APAC to Dominate LCD Display Panel Market During Forecast Period

Figure 63 Smartphone Segment to Dominate OLED Display Panel Market, in Terms of Size, During Forecast Period

Figure 64 APAC to Dominate OLED Display Panel Market, in Terms of Size, During Forecast Period

Figure 65 Micro-LED Display Panel Shipment to Surge Rapdily 2020 Onwards

Figure 66 APAC to Dominate Micro-LED Display Panel Market During Forecast Period

Figure 67 APAC to Dominate Direct-View LED Display Panel Market During Forecast Period

Figure 68 APAC to Dominate Display Panel Market for Other Technologies During Forecast Period

Figure 69 Display Panel Market Segmentation, By Panel Size

Figure 70 Small- and Medium-Sized Display Panels to Gain Market Share During Forecast Period

Figure 71 Micro-LED Based Microdisplays to Grow at Highest CAGR During Forecast Period

Figure 72 OLED to Emerge as Leading Display Technology in Small- and Medium-Sized Segment By 2024

Figure 73 LCD to Dominate Large-Sized Display Panel Market, in Terms of Size, During Forecast Period

Figure 74 Display Panel Market Segmentation, By Industry

Figure 75 Consumer Segment to Dominate Display Panel Market, in Terms of Size, During Forecast Period

Figure 76 Display Panel Market, By Region

Figure 77 Geographic Snapshot of Global Display Panel Market

Figure 78 Market in China Expected to Grow at Highest CAGR During Forecast Period

Figure 79 APAC to Dominate Display Panel Market During Forecast Period

Figure 80 APAC: Display Panel Market Snapshot

Figure 81 LCD Displays to Dominate Display Panel Market in APAC, in Terms of Size, During Forecast Period

Figure 82 China to Command Display Panel Market in APAC During Forecast Period

Figure 83 North America: Display Panel Market Snapshot

Figure 84 North America to Witness Decreasing Demand for LCD Panels During Forecast Period

Figure 85 Europe: Display Panel Market Snapshot

Figure 86 Germany to Lead Display Panel Market in Europe During Forecast Period

Figure 87 Key Developments By Leading Players in the Market Between 2015 and 2018

Figure 88 Key Player Market Share: Display Panel Market, 2017 vs 2018

Figure 89 Display Panel Market: Competitive Leadership Mapping, 2018

Figure 90 Samsung Electronics: Company Snapshot

Figure 91 LG Display: Company Snapshot

Figure 92 BOE Technology: Company Snapshot

Figure 93 AU Optronics: Company Snapshot

Figure 94 Innolux Corporation: Company Snapshot

Figure 95 Japan Display: Company Snapshot

Figure 96 Sharp: Company Snapshot

Figure 97 Tianma Microelecetronics: Company Snapshot

Figure 98 Truly International: Company Snapshot