2020/01/21 Yole - Automotive lighting industry: positioning for ADAS

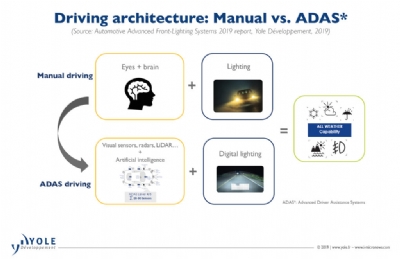

The digitalization of cars is a megatrend in the automotive industry, moving toward electric and autonomous vehicles. Today, digital lighting is a key area of research for the automotive lighting supply chain, since it enables smarter and safer lighting functionalities with Adaptive Driving Beams (ADB). On one hand, Tier-1s are developing high resolution headlamps to ensure a precise illumination of the road, while on the other hand they are also investigating implementing sensors in headlamps as corners are a good place for sensors related to automated driving.

The digitalization of cars is a megatrend in the automotive industry, moving toward electric and autonomous vehicles. Today, digital lighting is a key area of research for the automotive lighting supply chain, since it enables smarter and safer lighting functionalities with Adaptive Driving Beams (ADB). On one hand, Tier-1s are developing high resolution headlamps to ensure a precise illumination of the road, while on the other hand they are also investigating implementing sensors in headlamps as corners are a good place for sensors related to automated driving.

Radar and cameras are already well used in Advanced Driver-Assistance Systems (ADAS) vehicles, but the integration of Light Detection and Ranging (LiDAR) is still a question to be answered. Depending on the final use-case, LiDARs could be integrated in the center of vehicles for long-range applications or on the corners for short-range applications, such as traffic jam pilot. Since the emergence of LiDAR, their size has drastically decreased from 1,800cm3 for a big mechanical spinning LiDAR from Velodyne to less than 300cm3 for a solid-state LiDAR. This has allowed their integration into the grill, such as Audi’s use of the Valeo Scala. Further efforts are needed to shrink their size, and feedback from the industry has shown that a target volume of about 125cm3 for a LiDAR would be acceptable for integration into a headlamp.

This possibility to integrate LiDAR in headlamps raised the attention of headlamp manufacturers who have seen an opportunity to increase the added value of their products. As of today, major Tier-1s have partnered with LiDAR companies: Koito with Cepton and Blickfeld, Hella with AEye, and Varroc Lighting Systems with SILC. Valeo is developing its own LiDAR and ZKW is developing headlamps for autonomous driving in Project Dragonfly. But one major Tier-1 is missing in this landscape: Marelli, which had a previous partnership with Quanergy. Currently Quanergy seems less involved in the automotive field. This has changed recently as Marelli and Xenomatix announced during CES 2020 a joint development agreement for LiDAR solutions. This is part of Marelli’s development of the Smart Corner™ solution integrating multiple sensors for autonomous driving within vehicle headlamps and tail lamps. According to the Automotive Advanced Front Lighting Systems 2019 and LiDAR For Automotive and Industrial Applications 2019 reports, markets are forecast to reach ~$40B for front and rear lighting, with ~$11B for LiDAR in ADAS vehicles in 2030.

The number of companies developing LiDAR is still increasing with new companies emerging regularly. Most of them are targeting automotive applications and there may currently be too many LiDAR manufacturers to all survive. Some of them will die trying, some will target other markets such as security, mapping or industrial automation, and others will be acquired by larger companies. The remaining companies, that will be able to build strong partnerships with Tier-1s, will need to meet automotive requirements on safety, performance, reliability and cost. If they succeed, they will be able to generate massive revenues. This is a race that has already started, and laggards will be left behind.